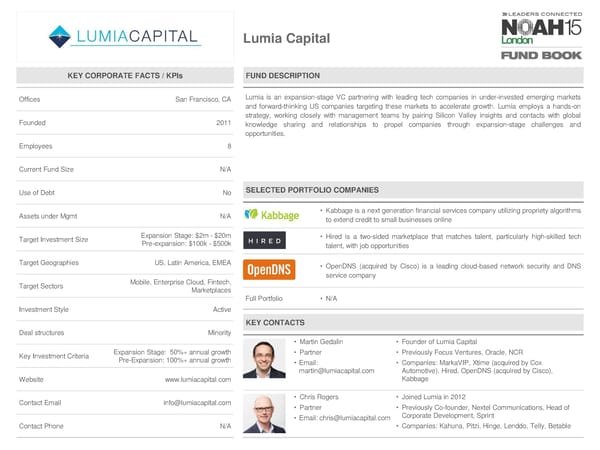

Lumia Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices San Francisco, CA Lumia is an expansion-stage VC partnering with leading tech companies in under-invested emerging markets and forward-thinking US companies targeting these markets to accelerate growth. Lumia employs a hands-on strategy, working closely with management teams by pairing Silicon Valley insights and contacts with global Founded 2011 knowledge sharing and relationships to propel companies through expansion-stage challenges and opportunities. Employees 8 Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Kabbage is a next generation financial services company utilizing propriety algorithms to extend credit to small businesses online Target Investment Size Expansion Stage: $2m - $20m • Hired is a two-sided marketplace that matches talent, particularly high-skilled tech Pre-expansion: $100k - $500k talent, with job opportunities Target Geographies US, Latin America, EMEA • OpenDNS (acquired by Cisco) is a leading cloud-based network security and DNS Mobile, Enterprise Cloud, Fintech, service company Target Sectors Marketplaces Full Portfolio • N/A Investment Style Active KEY CONTACTS Deal structures Minority • Martin Gedalin • Founder of Lumia Capital Key Investment Criteria Expansion Stage: 50%+ annual growth • Partner • Previously Focus Ventures, Oracle, NCR Pre-Expansion: 100%+ annual growth • Email: • Companies: MarkaVIP, Xtime (acquired by Cox [email protected] Automotive), Hired, OpenDNS (acquired by Cisco), Website www.lumiacapital.com Kabbage Contact Email [email protected] • Chris Rogers • Joined Lumia in 2012 • Partner • Previously Co-founder, Nextel Communications, Head of • Email: [email protected] Corporate Development, Sprint Contact Phone N/A • Companies: Kahuna, Pitzi, Hinge, Lenddo, Telly, Betable

NOAH15 London Fund Book Page 33 Page 35

NOAH15 London Fund Book Page 33 Page 35