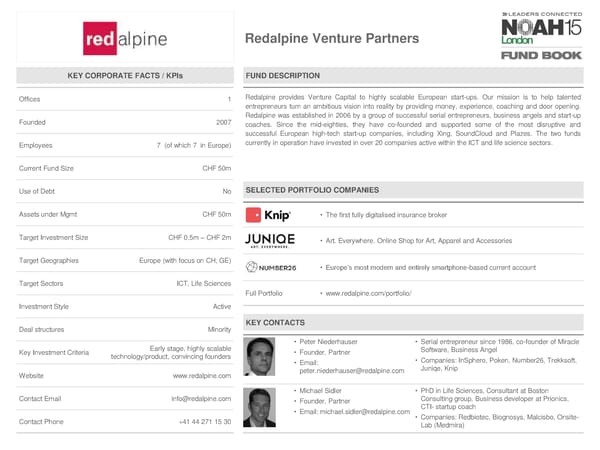

Redalpine Venture Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 Redalpine provides Venture Capital to highly scalable European start-ups. Our mission is to help talented entrepreneurs turn an ambitious vision into reality by providing money, experience, coaching and door opening. Founded 2007 Redalpine was established in 2006 by a group of successful serial entrepreneurs, business angels and start-up coaches. Since the mid-eighties, they have co-founded and supported some of the most disruptive and successful European high-tech start-up companies, including Xing, SoundCloud and Plazes. The two funds Employees 7 (of which 7 in Europe) currently in operation have invested in over 20 companies active within the ICT and life science sectors. Current Fund Size CHF 50m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt CHF 50m • The first fully digitalised insurance broker Target Investment Size CHF 0.5m – CHF 2m • Art. Everywhere. Online Shop for Art, Apparel and Accessories Target Geographies Europe (with focus on CH, GE) • Europe’s most modern and entirely smartphone-based current account Target Sectors ICT, Life Sciences Full Portfolio • www.redalpine.com/portfolio/ Investment Style Active Deal structures Minority KEY CONTACTS Early stage, highly scalable • Peter Niederhauser • Serial entrepreneur since 1986, co-founder of Miracle Key Investment Criteria technology/product, convincing founders • Founder, Partner Software, Business Angel • Email: • Companies: InSphero, Poken, Number26, Trekksoft, peter.niederhauser@redalpine.com Juniqe, Knip Website www.redalpine.com • Michael Sidler • PhD in Life Sciences, Consultant at Boston Contact Email info@redalpine.com • Founder, Partner Consulting group, Business developer at Prionics, • Email: michael.sidler@redalpine.com CTI- startup coach Contact Phone +41 44 271 15 30 • Companies: Redbiotec, Biognosys, Malcisbo, Onsite- Lab (Medmira)

NOAH15 London Fund Book Page 42 Page 44

NOAH15 London Fund Book Page 42 Page 44