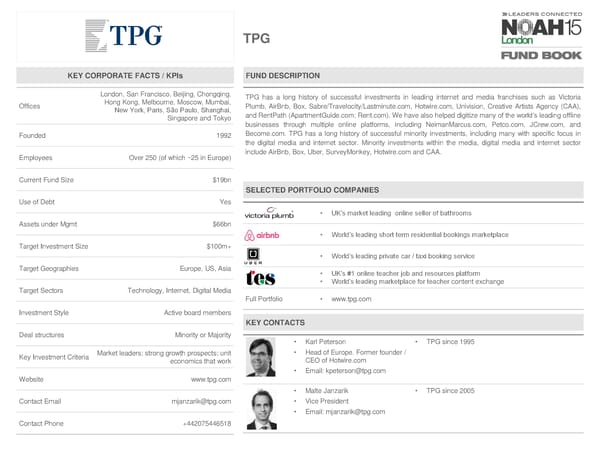

TPG KEY CORPORATE FACTS / KPIs FUND DESCRIPTION London, San Francisco, Beijing, Chongqing, TPG has a long history of successful investments in leading internet and media franchises such as Victoria Offices Hong Kong, Melbourne, Moscow, Mumbai, Plumb, AirBnb, Box, Sabre/Travelocity/Lastminute.com, Hotwire.com, Univision, Creative Artists Agency (CAA), New York, Paris, São Paulo, Shanghai, and RentPath (ApartmentGuide.com; Rent.com). We have also helped digitize many of the world’s leading offline Singapore and Tokyo businesses through multiple online platforms, including NeimanMarcus.com, Petco.com, JCrew.com, and Founded 1992 Become.com. TPG has a long history of successful minority investments, including many with specific focus in the digital media and internet sector. Minority investments within the media, digital media and internet sector Employees Over 250 (of which ~25 in Europe) include AirBnb, Box, Uber, SurveyMonkey, Hotwire.com and CAA. Current Fund Size $19bn SELECTED PORTFOLIO COMPANIES Use of Debt Yes • UK’s market leading online seller of bathrooms Assets under Mgmt $66bn • World’s leading short term residential bookings marketplace Target Investment Size $100m+ • World’s leading private car / taxi booking service Target Geographies Europe, US, Asia • UK’s #1 online teacher job and resources platform • World’s leading marketplace for teacher content exchange Target Sectors Technology, Internet, Digital Media Full Portfolio • www.tpg.com Investment Style Active board members KEY CONTACTS Deal structures Minority or Majority • Karl Peterson • TPG since 1995 Key Investment Criteria Market leaders; strong growth prospects; unit • Head of Europe. Former founder / economics that work CEO of Hotwire.com • Email: [email protected] Website www.tpg.com • Malte Janzarik • TPG since 2005 Contact Email [email protected] • Vice President • Email: [email protected] Contact Phone +442075446518

NOAH15 London Fund Book Page 81 Page 83

NOAH15 London Fund Book Page 81 Page 83