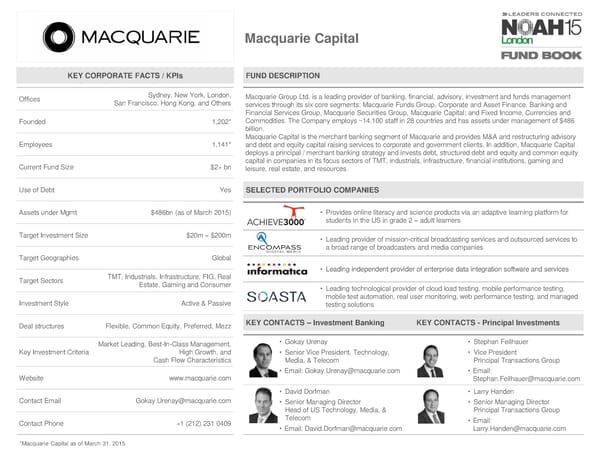

Macquarie Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Sydney, New York, London, Macquarie Group Ltd. is a leading provider of banking, financial, advisory, investment and funds management San Francisco, Hong Kong, and Others services through its six core segments: Macquarie Funds Group, Corporate and Asset Finance, Banking and Financial Services Group, Macquarie Securities Group, Macquarie Capital; and Fixed Income, Currencies and Founded 1,202* Commodities. The Company employs ~14.100 staff in 28 countries and has assets under management of $486 billion. Macquarie Capital is the merchant banking segment of Macquarie and provides M&A and restructuring advisory Employees 1,141* and debt and equity capital raising services to corporate and government clients. In addition, Macquarie Capital deploys a principal / merchant banking strategy and invests debt, structured debt and equity and common equity Current Fund Size $2+ bn capital in companies in its focus sectors of TMT, industrials, infrastructure, financial institutions, gaming and leisure, real estate, and resources. Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt $486bn (as of March 2015) • Provides online literacy and science products via an adaptive learning platform for students in the US in grade 2 – adult learners Target Investment Size $20m–$200m • Leading provider of mission-critical broadcasting services and outsourced services to a broad range of broadcasters and media companies Target Geographies Global • Leading independent provider of enterprise data integration software and services Target Sectors TMT, Industrials, Infrastructure, FIG, Real Estate, Gaming and Consumer • Leading technological provider of cloud load testing, mobile performance testing, Investment Style Active & Passive mobile test automation, real user monitoring, web performance testing, and managed testing solutions Deal structures Flexible, Common Equity, Preferred, Mezz KEY CONTACTS –Investment Banking KEY CONTACTS -Principal Investments Market Leading, Best-In-Class Management, • Gokay Urenay • Stephan Feilhauer Key Investment Criteria High Growth, and • Senior Vice President, Technology, • Vice President Cash Flow Characteristics Media, & Telecom Principal Transactions Group • Email: Gokay.Urenay@macquarie.com • Email: Website www.macquarie.com Stephan.Feilhauer@macquarie.com • David Dorfman • Larry Handen Contact Email Gokay.Urenay@macquarie.com • Senior Managing Director • Senior Managing Director Head of US Technology, Media, & Principal Transactions Group Contact Phone +1 (212) 231 0409 Telecom • Email: • Email: David.Dorfman@macquarie.com Larry.Handen@macquarie.com *Macquarie Capital as of March 31, 2015

NOAH15 London Fund Book Page 78 Page 80

NOAH15 London Fund Book Page 78 Page 80