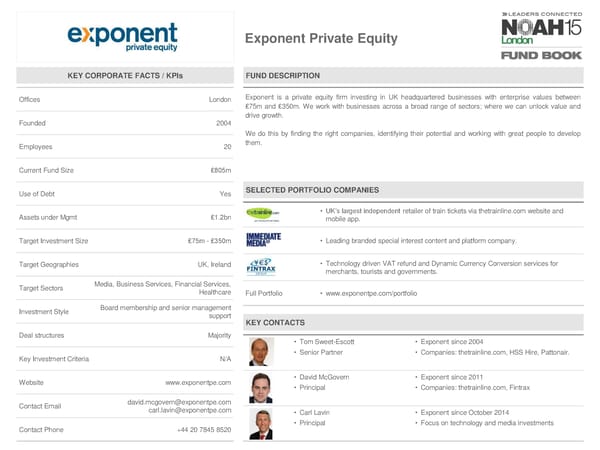

Exponent Private Equity KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Exponent is a private equity firm investing in UK headquartered businesses with enterprise values between £75m and £350m. We work with businesses across a broad range of sectors; where we can unlock value and drive growth. Founded 2004 Wedo this by finding the right companies, identifying their potential and working with great people to develop Employees 20 them. Current Fund Size £805m Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt £1.2bn • UK’s largest independent retailer of train tickets via thetrainline.com website and mobile app. Target Investment Size £75m-£350m • Leading branded special interest content and platform company. Target Geographies UK,Ireland • Technology driven VAT refund and Dynamic Currency Conversion services for merchants, tourists and governments. Target Sectors Media, Business Services, Financial Services, Healthcare Full Portfolio • www.exponentpe.com/portfolio Investment Style Board membershipand senior management support KEY CONTACTS Deal structures Majority • Tom Sweet-Escott • Exponent since 2004 Key Investment Criteria N/A • Senior Partner • Companies: thetrainline.com, HSS Hire, Pattonair. Website www.exponentpe.com • David McGovern • Exponent since 2011 • Principal • Companies: thetrainline.com, Fintrax Contact Email david.mcgovern@exponentpe.com carl.lavin@exponentpe.com • Carl Lavin • Exponent since October 2014 Contact Phone +4420 7845 8520 • Principal • Focus on technology and media investments

NOAH15 London Fund Book Page 77 Page 79

NOAH15 London Fund Book Page 77 Page 79