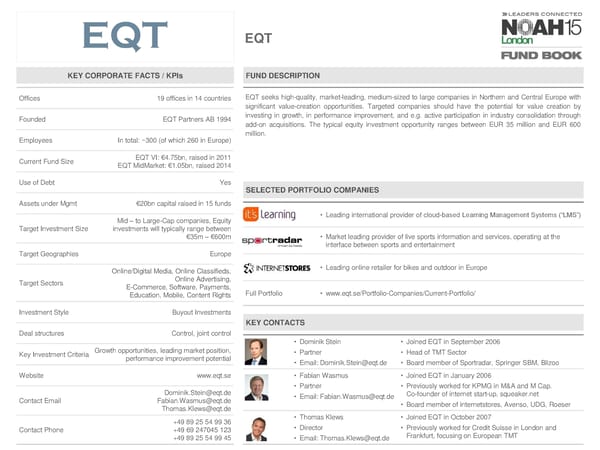

EQT KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 19 offices in 14 countries EQTseeks high-quality, market-leading, medium-sized to large companies in Northern and Central Europe with significant value-creation opportunities. Targeted companies should have the potential for value creation by Founded EQT Partners AB 1994 investing in growth, in performance improvement, and e.g. active participation in industry consolidation through add-on acquisitions. The typical equity investment opportunity ranges between EUR 35 million and EUR 600 Employees In total: ~300 (of which 260 in Europe) million. Current Fund Size EQT VI: €4.75bn, raised in 2011 EQT MidMarket: €1.05bn, raised 2014 Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt €20bn capital raised in 15 funds Mid – to Large-Cap companies, Equity • Leading international provider of cloud-based Learning Management Systems (“LMS”) Target Investment Size investments will typically range between €35m – €600m • Market leading provider of live sports information and services, operating at the interface between sports and entertainment Target Geographies Europe Online/Digital Media, Online Classifieds, • Leading online retailer for bikes and outdoor in Europe Target Sectors Online Advertising, E-Commerce, Software, Payments, Full Portfolio • www.eqt.se/Portfolio-Companies/Current-Portfolio/ Education, Mobile, Content Rights Investment Style Buyout Investments KEY CONTACTS Deal structures Control, joint control • Dominik Stein • Joined EQT in September 2006 Key Investment Criteria Growth opportunities, leading market position, • Partner • Head of TMT Sector performance improvement potential • Email: [email protected] • Board member of Sportradar, Springer SBM, Blizoo Website www.eqt.se • Fabian Wasmus • Joined EQT in January 2006 [email protected] • Partner • Previously worked for KPMG in M&A and M Cap. Contact Email [email protected] • Email: [email protected] Co-founder of internet start-up, squeaker.net [email protected] • Board member of internetstores, Avenso, UDG, Roeser +49 89 25 54 99 36 • Thomas Klews • Joined EQT in October 2007 Contact Phone +4969 247045 123 • Director • Previously worked for Credit Suisse in London and +49 89 25 54 99 45 • Email: [email protected] Frankfurt, focusing on European TMT

NOAH15 London Fund Book Page 76 Page 78

NOAH15 London Fund Book Page 76 Page 78