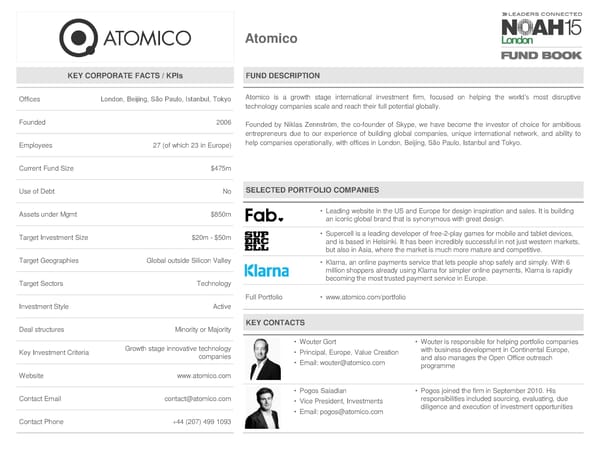

Atomico KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Beijing, São Paulo, Istanbul, Tokyo Atomico is a growth stage international investment firm, focused on helping the world’s most disruptive technology companies scale and reach their full potential globally. Founded 2006 Founded by Niklas Zennström, the co-founder of Skype, we have become the investor of choice for ambitious entrepreneurs due to our experience of building global companies, unique international network, and ability to Employees 27 (of which 23 in Europe) help companies operationally, with offices in London, Beijing, São Paulo, Istanbul and Tokyo. Current Fund Size $475m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $850m • Leading website in the US and Europe for design inspiration and sales. It is building an iconic global brand that is synonymous with great design. Target Investment Size $20m-$50m • Supercell is a leading developer of free-2-play games for mobile and tablet devices, and is based in Helsinki. It has been incredibly successful in not just western markets, but also in Asia, where the market is much more mature and competitive. Target Geographies Global outside Silicon Valley • Klarna, an online payments service that lets people shop safely and simply. With 6 million shoppers already using Klarna for simpler online payments, Klarna is rapidly Target Sectors Technology becoming the most trusted payment service in Europe. Full Portfolio • www.atomico.com/portfolio Investment Style Active Deal structures Minority or Majority KEY CONTACTS Growth stage innovative technology • WouterGort • Wouteris responsible for helping portfolio companies Key Investment Criteria companies • Principal, Europe, Value Creation with business development in Continental Europe, • Email: wouter@atomico.com and also manages the Open Office outreach programme Website www.atomico.com • Pogos Saiadian • Pogos joined the firm in September 2010. His Contact Email contact@atomico.com • Vice President, Investments responsibilities included sourcing, evaluating, due • Email: pogos@atomico.com diligence and execution of investment opportunities Contact Phone +44 (207) 499 1093

NOAH15 London Fund Book Page 57 Page 59

NOAH15 London Fund Book Page 57 Page 59