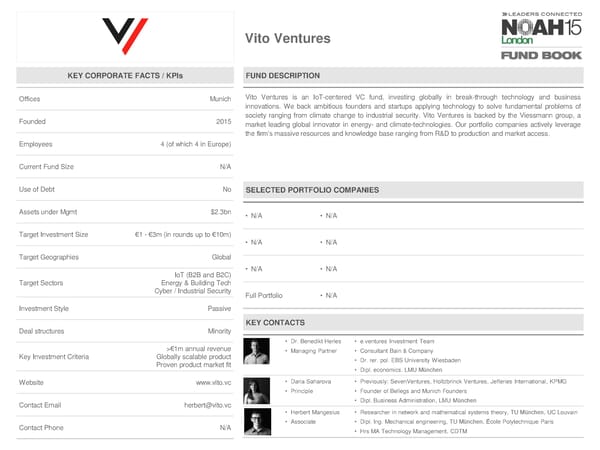

Vito Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Munich Vito Ventures is an IoT-centered VC fund, investing globally in break-through technology and business innovations. We back ambitious founders and startups applying technology to solve fundamental problems of Founded 2015 society ranging from climate change to industrial security. Vito Ventures is backed by the Viessmann group, a market leading global innovator in energy- and climate-technologies. Our portfolio companies actively leverage the firm’s massive resources and knowledge base ranging from R&D to production and market access. Employees 4 (of which 4 in Europe) Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $2.3bn • N/A • N/A Target Investment Size €1 - €3m (in rounds up to €10m) • N/A • N/A Target Geographies Global IoT (B2B and B2C) • N/A • N/A Target Sectors Energy & Building Tech Cyber / Industrial Security Full Portfolio • N/A Investment Style Passive KEY CONTACTS Deal structures Minority • Dr. Benedikt Herles • e.ventures Investment Team >€1m annual revenue • Managing Partner • Consultant Bain & Company Key Investment Criteria Globally scalable product • Dr. rer. pol. EBS University Wiesbaden Proven product market fit • Dipl. economics. LMU München Website www.vito.vc • Daria Saharova • Previously: SevenVentures, Holtzbrinck Ventures, Jefferies International, KPMG • Principle • Founder of Bellegs and Munich Founders Contact Email herbert@vito.vc • Dipl. Business Administration, LMU München • Herbert Mangesius • Researcher in network and mathematical systems theory, TU München, UC Louvain Contact Phone N/A • Associate • Dipl. Ing. Mechanical engineering, TU München, École Polytechnique Paris • Hrs MA Technology Management, CDTM

NOAH15 London Fund Book Page 52 Page 54

NOAH15 London Fund Book Page 52 Page 54