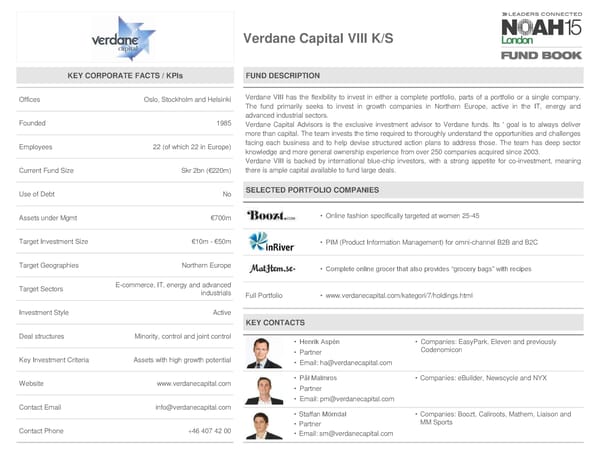

VerdaneCapital VIII K/S KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Oslo, Stockholm and Helsinki Verdane VIII has the flexibility to invest in either a complete portfolio, parts of a portfolio or a single company. The fund primarily seeks to invest in growth companies in Northern Europe, active in the IT, energy and advanced industrial sectors. Founded 1985 Verdane Capital Advisors is the exclusive investment advisor to Verdane funds. Its ' goal is to always deliver more than capital. The team invests the time required to thoroughly understand the opportunities and challenges Employees 22 (of which 22 in Europe) facing each business and to help devise structured action plans to address those. The team has deep sector knowledge and more general ownership experience from over 250 companies acquired since 2003. Verdane VIII is backed by international blue-chip investors, with a strong appetite for co-investment, meaning Current Fund Size Skr 2bn (€220m) there is ample capital available to fund large deals. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €700m • Online fashion specifically targeted at women 25-45 Target Investment Size €10m - €50m • PIM (Product Information Management) for omni-channel B2B and B2C Target Geographies Northern Europe • Complete online grocer that also provides “grocery bags” with recipes Target Sectors E-commerce, IT, energy and advanced industrials Full Portfolio • www.verdanecapital.com/kategori/7/holdings.html Investment Style Active KEY CONTACTS Deal structures Minority, control and joint control • Henrik Aspén • Companies: EasyPark, Eleven and previously • Partner Codenomicon Key Investment Criteria Assets with high growth potential • Email: [email protected] Website www.verdanecapital.com • Pål Malmros • Companies: eBuilder, Newscycle and NYX • Partner • Email: [email protected] Contact Email [email protected] • Staffan Mörndal • Companies: Boozt, Caliroots, Mathem, Liaison and • Partner MM Sports Contact Phone +46 407 42 00 • Email: [email protected]

NOAH15 London Fund Book Page 51 Page 53

NOAH15 London Fund Book Page 51 Page 53