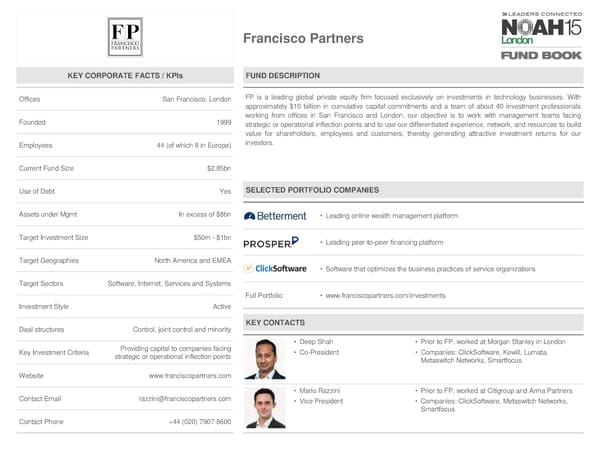

Francisco Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices San Francisco, London FP is a leading global private equity firm focused exclusively on investments in technology businesses. With approximately $10 billion in cumulative capital commitments and a team of about 40 investment professionals Founded 1999 working from offices in San Francisco and London, our objective is to work with management teams facing strategic or operational inflection points and to use our differentiated experience, network, and resources to build value for shareholders, employees and customers, thereby generating attractive investment returns for our Employees 44 (of which 8 in Europe) investors. Current Fund Size $2.85bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt In excess of $8bn • Leading online wealth management platform Target Investment Size $50m - $1bn • Leading peer-to-peer financing platform Target Geographies North America and EMEA • Software that optimizes the business practices of service organizations Target Sectors Software, Internet, Services and Systems Full Portfolio • www.franciscopartners.com/investments Investment Style Active Deal structures Control, joint control and minority KEY CONTACTS Providing capital to companies facing • Deep Shah • Prior to FP, worked at Morgan Stanley in London Key Investment Criteria strategic or operational inflection points • Co-President • Companies: ClickSoftware, Kewill, Lumata, Metaswitch Networks, Smartfocus Website www.franciscopartners.com • Mario Razzini • Prior to FP, worked at Citigroup and Arma Partners Contact Email [email protected] • Vice President • Companies: ClickSoftware, Metaswitch Networks, Smartfocus Contact Phone +44 (020) 7907 8600

NOAH15 London Fund Book Page 59 Page 61

NOAH15 London Fund Book Page 59 Page 61