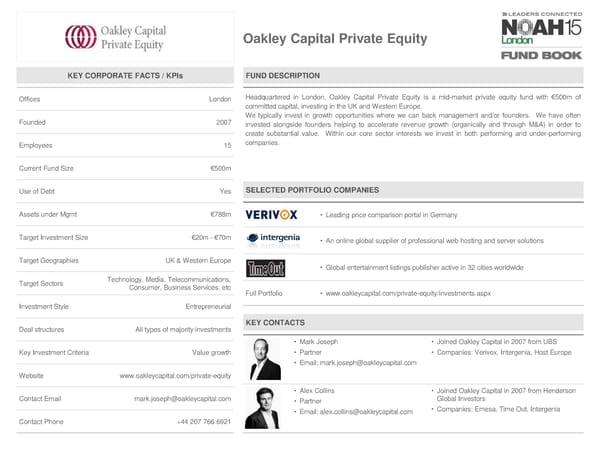

Oakley Capital Private Equity KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Headquartered in London, Oakley Capital Private Equity is a mid-market private equity fund with €500m of committedcapital, investing in the UK and Western Europe. Founded 2007 Wetypically invest in growth opportunities where we can back management and/or founders. We have often invested alongside founders helping to accelerate revenue growth (organically and through M&A) in order to create substantial value. Within our core sector interests we invest in both performing and under-performing Employees 15 companies. Current Fund Size €500m Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt €788m • Leading price comparison portal in Germany Target Investment Size €20m - €70m • An online global supplier of professional web hosting and server solutions Target Geographies UK & Western Europe • Global entertainment listings publisher active in 32 cities worldwide Target Sectors Technology, Media, Telecommunications, Consumer, Business Services, etc Full Portfolio • www.oakleycapital.com/private-equity/investments.aspx Investment Style Entrepreneurial Deal structures All types of majority investments KEY CONTACTS • Mark Joseph • Joined Oakley Capital in 2007 from UBS Key Investment Criteria Value growth • Partner • Companies: Verivox, Intergenia, Host Europe • Email: [email protected] Website www.oakleycapital.com/private-equity • Alex Collins • Joined Oakley Capital in 2007 from Henderson Contact Email [email protected] • Partner Global Investors • Email: [email protected] • Companies: Emesa, Time Out, Intergenia Contact Phone +44 207 766 6921

NOAH15 London Fund Book Page 67 Page 69

NOAH15 London Fund Book Page 67 Page 69