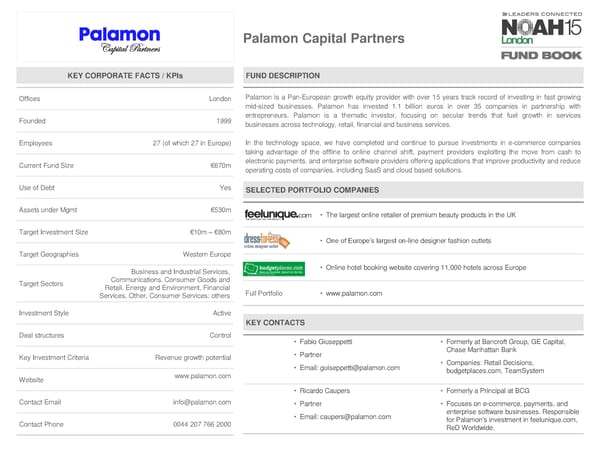

PalamonCapital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Palamon is a Pan-European growth equity provider with over 15 years track record of investing in fast growing mid-sized businesses. Palamon has invested 1.1 billion euros in over 35 companies in partnership with Founded 1999 entrepreneurs. Palamon is a thematic investor, focusing on secular trends that fuel growth in services businesses across technology, retail, financial and business services. Employees 27 (of which 27 in Europe) In the technology space, we have completed and continue to pursue investments in e-commerce companies taking advantage of the offline to online channel shift, payment providers exploiting the move from cash to Current Fund Size €670m electronic payments, and enterprise software providers offering applications that improve productivity and reduce operating costs of companies, including SaaS and cloud based solutions. Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt €530m • The largest online retailer of premium beauty products in the UK Target Investment Size €10m – €80m • One of Europe’s largest on-line designer fashion outlets Target Geographies Western Europe Business and Industrial Services, • Online hotel booking website covering 11,000 hotels across Europe Target Sectors Communications, Consumer Goods and Retail, Energy and Environment, Financial Full Portfolio • www.palamon.com Services, Other, Consumer Services: others Investment Style Active KEY CONTACTS Deal structures Control • Fabio Giuseppetti • Formerly at Bancroft Group, GE Capital, • Partner Chase Manhattan Bank Key Investment Criteria Revenue growth potential • Companies: Retail Decisions, • Email: [email protected] budgetplaces.com, TeamSystem Website www.palamon.com • Ricardo Caupers • Formerly a Principal at BCG Contact Email [email protected] • Partner • Focuses on e-commerce, payments, and • Email: [email protected] enterprise software businesses. Responsible Contact Phone 0044 207 766 2000 for Palamon's investment in feelunique.com, ReDWorldwide.

NOAH15 London Fund Book Page 68 Page 70

NOAH15 London Fund Book Page 68 Page 70