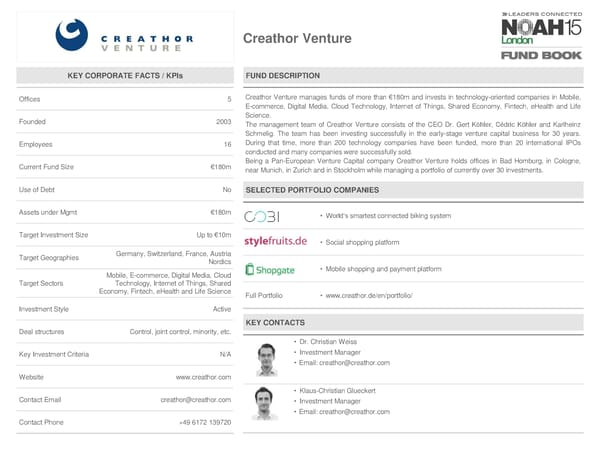

Creathor Venture KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 5 Creathor Venture manages funds of more than €180m and invests in technology-oriented companies in Mobile, E-commerce, Digital Media, Cloud Technology, Internet of Things, Shared Economy, Fintech, eHealth and Life Founded 2003 Science. The management team of Creathor Venture consists of the CEO Dr. Gert Köhler, Cédric Köhler and Karlheinz Schmelig. The team has been investing successfully in the early-stage venture capital business for 30 years. Employees 16 During that time, more than 200 technology companies have been funded, more than 20 international IPOs conducted and many companies were successfullysold. Current Fund Size €180m Being a Pan-European Venture Capital company Creathor Venture holds offices in Bad Homburg, in Cologne, near Munich, in Zurich and in Stockholm while managing a portfolio of currently over 30 investments. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €180m • World‘s smartest connected biking system Target Investment Size Upto €10m • Social shopping platform Target Geographies Germany, Switzerland, France, Austria Nordics Mobile, E-commerce, Digital Media, Cloud • Mobile shopping and payment platform Target Sectors Technology, Internet of Things, Shared Economy, Fintech, eHealth and Life Science Full Portfolio • www.creathor.de/en/portfolio/ Investment Style Active KEY CONTACTS Deal structures Control, joint control, minority, etc. • Dr. Christian Weiss Key Investment Criteria N/A • Investment Manager • Email: creathor@creathor.com Website www.creathor.com • Klaus-Christian Glueckert Contact Email creathor@creathor.com • Investment Manager • Email: creathor@creathor.com Contact Phone +49 6172 139720

NOAH15 London Fund Book Page 16 Page 18

NOAH15 London Fund Book Page 16 Page 18