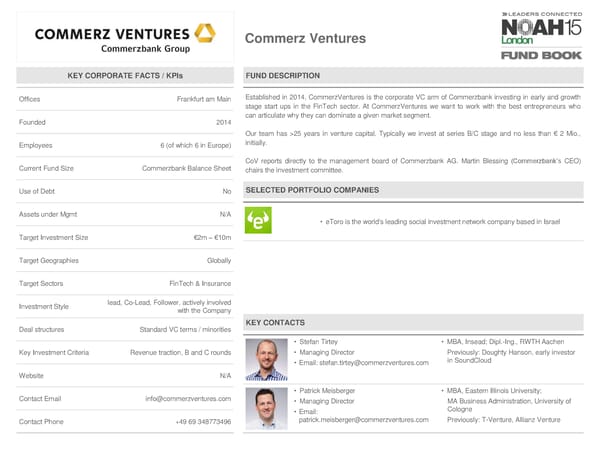

CommerzVentures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Frankfurt am Main Established in 2014, CommerzVentures is the corporate VC arm of Commerzbank investing in early and growth stage start ups in the FinTech sector. At CommerzVentures we want to work with the best entrepreneurs who Founded 2014 can articulate why they can dominate a given market segment. Our team has >25 years in venture capital. Typically we invest at series B/C stage and no less than € 2 Mio., Employees 6 (of which 6 in Europe) initially. CoV reports directly to the management board of Commerzbank AG. Martin Blessing (Commerzbank’s CEO) Current Fund Size Commerzbank Balance Sheet chairs the investment committee. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • eToro is the world's leading social investment network company based in Israel Target Investment Size €2m – €10m Target Geographies Globally Target Sectors FinTech & Insurance Investment Style lead, Co-Lead, Follower, actively involved with the Company Deal structures Standard VC terms / minorities KEY CONTACTS • Stefan Tirtey • MBA, Insead; Dipl.-Ing., RWTH Aachen Key Investment Criteria Revenue traction, B and C rounds • Managing Director Previously: Doughty Hanson, early investor • Email: [email protected] in SoundCloud Website N/A • Patrick Meisberger • MBA, Eastern Illinois University; Contact Email [email protected] • Managing Director MA Business Administration, University of • Email: Cologne Contact Phone +49 69 348773496 [email protected] Previously: T-Venture, Allianz Venture

NOAH15 London Fund Book Page 15 Page 17

NOAH15 London Fund Book Page 15 Page 17