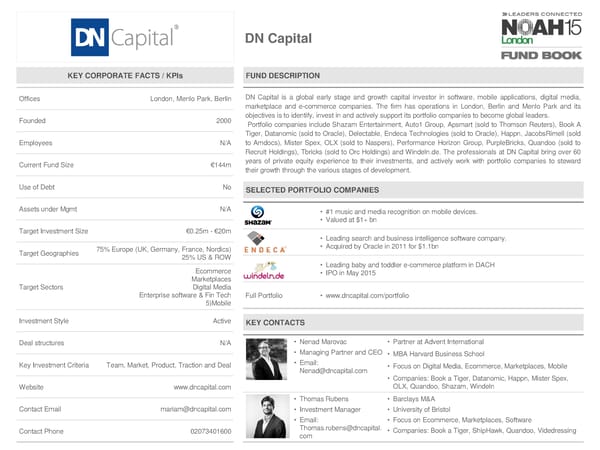

DN Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Menlo Park, Berlin DN Capital is a global early stage and growth capital investor in software, mobile applications, digital media, marketplace and e-commerce companies. The firm has operations in London, Berlin and Menlo Park and its Founded 2000 objectives is to identify, invest in and actively support its portfolio companies to become global leaders. Portfolio companies include Shazam Entertainment, Auto1 Group, Apsmart (sold to Thomson Reuters), Book A Tiger, Datanomic (sold to Oracle), Delectable, Endeca Technologies (sold to Oracle), Happn, JacobsRimell (sold Employees N/A to Amdocs), Mister Spex, OLX (sold to Naspers), Performance Horizon Group, PurpleBricks, Quandoo (sold to Recruit Holdings), Tbricks (sold to Orc Holdings) and Windeln.de. The professionals at DN Capital bring over 60 Current Fund Size €144m years of private equity experience to their investments, and actively work with portfolio companies to steward their growth through the various stages of development. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • #1 music and media recognition on mobile devices. • Valued at $1+ bn Target Investment Size €0.25m - €20m • Leading search and business intelligence software company. 75% Europe (UK, Germany, France, Nordics) • Acquired by Oracle in 2011 for $1.1bn Target Geographies 25% US & ROW Ecommerce • Leading baby and toddler e-commerce platform in DACH Marketplaces • IPO in May 2015 Target Sectors Digital Media Enterprise software & Fin Tech Full Portfolio • www.dncapital.com/portfolio 5)Mobile Investment Style Active KEY CONTACTS Deal structures N/A • Nenad Marovac • Partner at Advent International • Managing Partner and CEO • MBA Harvard Business School Key Investment Criteria Team,Market, Product, Traction and Deal • Email: • Focus on Digital Media, Ecommerce, Marketplaces, Mobile Nenad@dncapital.com • Companies: Book a Tiger, Datanomic, Happn, Mister Spex, Website www.dncapital.com OLX, Quandoo, Shazam, Windeln • Thomas Rubens • Barclays M&A Contact Email mariam@dncapital.com • Investment Manager • University of Bristol • Email: • Focus on Ecommerce, Marketplaces, Software Contact Phone 02073401600 Thomas.rubens@dncapital. • Companies: Book a Tiger, ShipHawk, Quandoo, Videdressing com

NOAH15 London Fund Book Page 17 Page 19

NOAH15 London Fund Book Page 17 Page 19