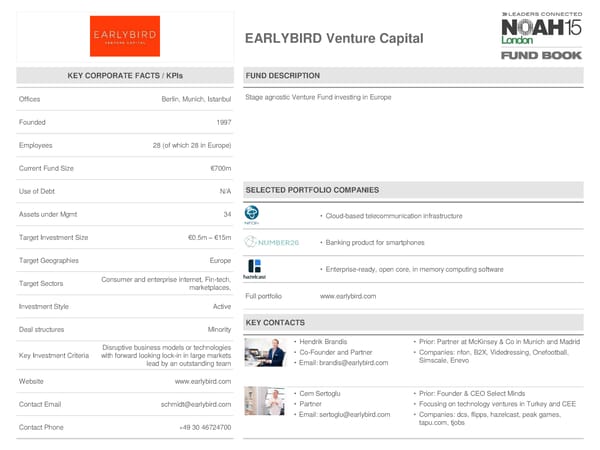

EARLYBIRD Venture Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Berlin, Munich, Istanbul Stage agnostic Venture Fund investing in Europe Founded 1997 Employees 28 (of which 28 in Europe) Current Fund Size €700m Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt 34 • Cloud-based telecommunication infrastructure Target Investment Size €0.5m – €15m • Banking product for smartphones Target Geographies Europe • Enterprise-ready, open core, in memory computing software Target Sectors Consumer and enterprise internet, Fin-tech, marketplaces, Full portfolio www.earlybird.com Investment Style Active Deal structures Minority KEY CONTACTS Disruptive business models or technologies • Hendrik Brandis • Prior: Partner at McKinsey & Co in Munich and Madrid Key Investment Criteria with forward looking lock-in in large markets • Co-Founder and Partner • Companies: nfon, B2X, Videdressing, Onefootball, lead by an outstanding team • Email: [email protected] Simscale, Enevo Website www.earlybird.com • CemSertoglu • Prior: Founder & CEO Select Minds Contact Email [email protected] • Partner • Focusing on technology ventures in Turkey and CEE • Email: [email protected] • Companies: dcs, flipps, hazelcast, peak games, Contact Phone +4930 46724700 tapu.com, tjobs

NOAH15 London Fund Book Page 18 Page 20

NOAH15 London Fund Book Page 18 Page 20