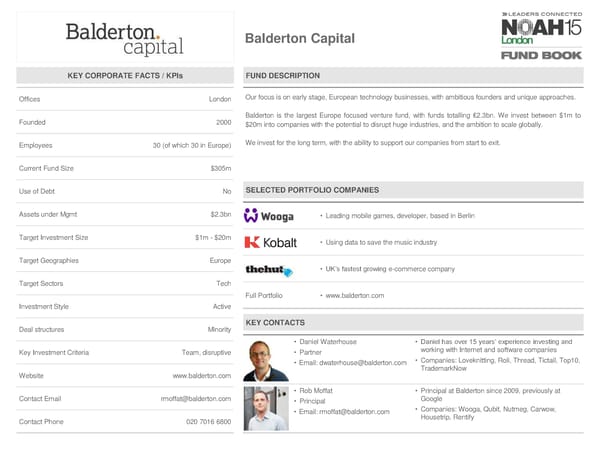

Balderton Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Our focus is on early stage, European technology businesses, with ambitious founders and unique approaches. Founded 2000 Balderton is the largest Europe focused venture fund, with funds totalling £2.3bn. We invest between $1m to $20minto companieswith the potential to disrupt huge industries, and the ambition to scale globally. Employees 30 (of which 30 in Europe) Weinvest for the long term, with the ability to support our companies from start to exit. Current Fund Size $305m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $2.3bn • Leading mobile games, developer, based in Berlin Target Investment Size $1m-$20m • Using data to save the music industry Target Geographies Europe • UK’s fastest growing e-commerce company Target Sectors Tech Full Portfolio • www.balderton.com Investment Style Active Deal structures Minority KEY CONTACTS • Daniel Waterhouse • Daniel has over 15 years’ experience investing and Key Investment Criteria Team, disruptive • Partner working with Internet and software companies • Email: [email protected] • Companies: Loveknitting, Roli, Thread, Tictail, Top10, TrademarkNow Website www.balderton.com • Rob Moffat • Principal at Balderton since 2009, previously at Contact Email [email protected] • Principal Google • Email: [email protected] • Companies: Wooga, Qubit, Nutmeg, Carwow, Contact Phone 020 7016 6800 Housetrip, Rentify

NOAH15 London Fund Book Page 12 Page 14

NOAH15 London Fund Book Page 12 Page 14