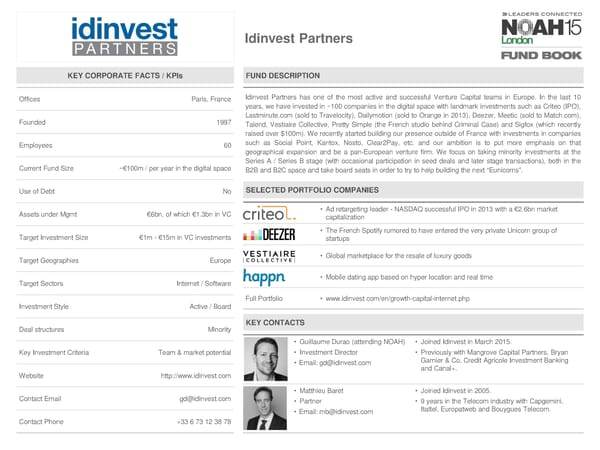

Idinvest Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris, France Idinvest Partners has one of the most active and successful Venture Capital teams in Europe. In the last 10 years, we have invested in ~100 companies in the digital space with landmark investments such as Criteo (IPO), Founded 1997 Lastminute.com (sold to Travelocity), Dailymotion (sold to Orange in 2013), Deezer, Meetic (sold to Match.com), Talend, Vestiaire Collective, Pretty Simple (the French studio behind Criminal Case) and Sigfox (which recently raised over $100m). We recently started building our presence outside of France with investments in companies Employees 60 such as Social Point, Kantox, Nosto, Clear2Pay, etc. and our ambition is to put more emphasis on that geographical expansion and be a pan-European venture firm. We focus on taking minority investments at the Series A / Series B stage (with occasional participation in seed deals and later stage transactions), both in the Current Fund Size ~€100m / per year in the digital space B2BandB2Cspaceandtakeboard seatsinorder totrytohelp building the next “Eunicorns”. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €6bn, of which €1.3bn in VC • Ad retargeting leader - NASDAQ successful IPO in 2013 with a €2.6bn market capitalization • The French Spotify rumored to have entered the very private Unicorn group of Target Investment Size €1m - €15m in VC investments startups Target Geographies Europe • Global marketplace for the resale of luxury goods Target Sectors Internet / Software • Mobile dating app based on hyper location and real time Full Portfolio • www.idinvest.com/en/growth-capital-internet.php Investment Style Active / Board Deal structures Minority KEY CONTACTS • Guillaume Durao (attending NOAH) • Joined Idinvest in March 2015. Key Investment Criteria Team &marketpotential • Investment Director • Previously with Mangrove Capital Partners, Bryan • Email: [email protected] Garnier & Co, Credit Agricole Investment Banking and Canal+. Website http://www.idinvest.com • Matthieu Baret • Joined Idinvest in 2005. Contact Email [email protected] • Partner • 9 years in the Telecom industry with Capgemini, • Email: [email protected] Italtel, Europatweb and Bouygues Telecom. Contact Phone +33 6 73 12 38 78

NOAH15 London Fund Book Page 29 Page 31

NOAH15 London Fund Book Page 29 Page 31