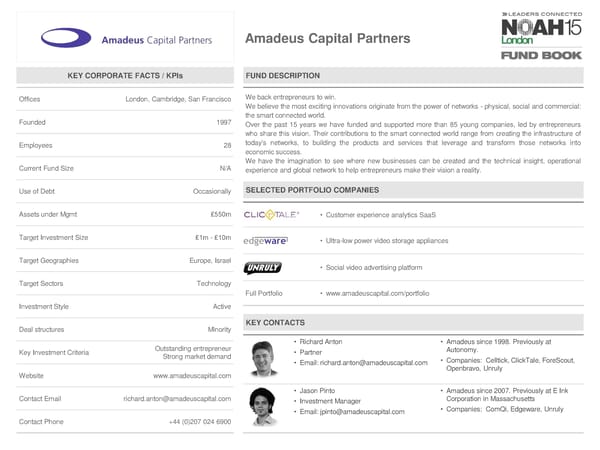

Amadeus Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Cambridge, San Francisco Webackentrepreneurs to win. Webelieve the most exciting innovations originate from the power of networks - physical, social and commercial: Founded 1997 the smart connected world. Over the past 15 years we have funded and supported more than 85 young companies, led by entrepreneurs who share this vision. Their contributions to the smart connected world range from creating the infrastructure of Employees 28 today's networks, to building the products and services that leverage and transform those networks into economicsuccess. Wehave the imagination to see where new businesses can be created and the technical insight, operational Current Fund Size N/A experience and global network to help entrepreneurs make their vision a reality. Use of Debt Occasionally SELECTED PORTFOLIO COMPANIES Assets under Mgmt £550m • Customer experience analytics SaaS Target Investment Size £1m-£10m • Ultra-low power video storage appliances Target Geographies Europe, Israel • Social video advertising platform Target Sectors Technology Full Portfolio • www.amadeuscapital.com/portfolio Investment Style Active Deal structures Minority KEY CONTACTS Outstanding entrepreneur • Richard Anton • Amadeus since 1998. Previously at Key Investment Criteria Strong market demand • Partner Autonomy. • Email: richard.anton@amadeuscapital.com • Companies: Celltick, ClickTale, ForeScout, Openbravo, Unruly Website www.amadeuscapital.com • Jason Pinto • Amadeus since 2007. Previously at E Ink Contact Email richard.anton@amadeuscapital.com • Investment Manager Corporation in Massachusetts • Email: jpinto@amadeuscapital.com • Companies: ComQi, Edgeware, Unruly Contact Phone +44 (0)207 024 6900

NOAH15 London Fund Book Page 10 Page 12

NOAH15 London Fund Book Page 10 Page 12