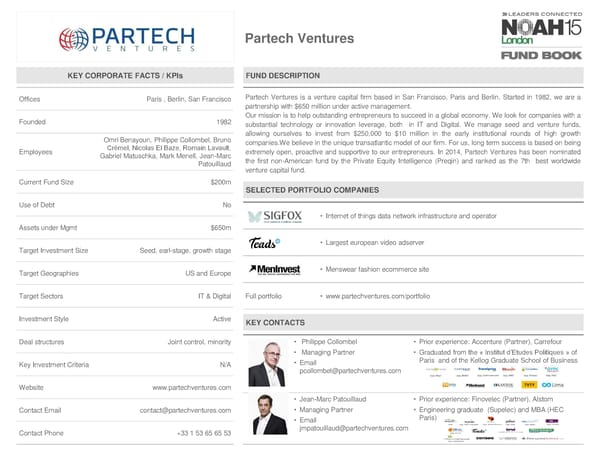

Partech Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris , Berlin, San Francisco Partech Ventures is a venture capital firm based in San Francisco, Paris and Berlin. Started in 1982, we are a partnership with $650 million under active management. Founded 1982 Our mission is to help outstanding entrepreneurs to succeed in a global economy. We look for companies with a substantial technology or innovation leverage, both in IT and Digital. We manage seed and venture funds, Omri Benayoun, Philippe Collombel, Bruno allowing ourselves to invest from $250,000 to $10 million in the early institutional rounds of high growth companies.Webelieve in the unique transatlantic model of our firm. For us, long term success is based on being Employees Crémel, Nicolas El Baze, Romain Lavault, extremely open, proactive and supportive to our entrepreneurs. In 2014, Partech Ventures has been nominated Gabriel Matuschka, Mark Menell, Jean-Marc the first non-American fund by the Private Equity Intelligence (Preqin) and ranked as the 7th best worldwide Patouillaud venture capital fund. Current Fund Size $200m SELECTED PORTFOLIO COMPANIES Use of Debt No • Internet of things data network infrastructure and operator Assets under Mgmt $650m • Largest european video adserver Target Investment Size Seed, earl-stage, growth stage Target Geographies US and Europe • Menswear fashion ecommerce site Target Sectors IT & Digital Full portfolio • www.partechventures.com/portfolio Investment Style Active KEY CONTACTS Deal structures Joint control, minority • Philippe Collombel • Prior experience: Accenture (Partner), Carrefour • Managing Partner • Graduated from the « Institut d’Etudes Politiques » of Key Investment Criteria N/A • Email Paris and of the Kellog Graduate School of Business [email protected] Website www.partechventures.com • Jean-Marc Patouillaud • Prior experience: Finovelec (Partner), Alstom Contact Email [email protected] • Managing Partner • Engineering graduate (Supelec) and MBA (HEC • Email Paris) Contact Phone +33 1 53 65 65 53 [email protected]

NOAH15 London Fund Book Page 39 Page 41

NOAH15 London Fund Book Page 39 Page 41