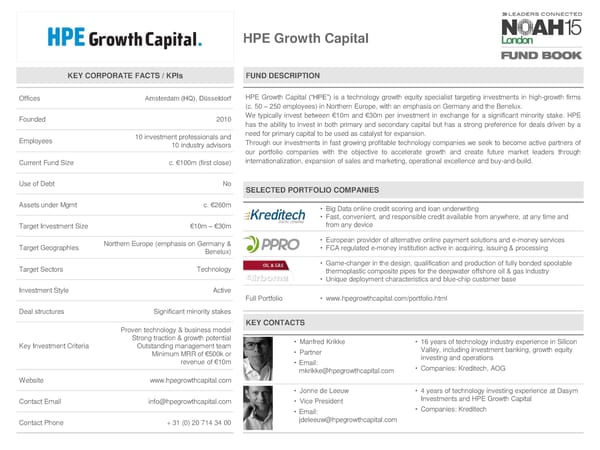

HPE Growth Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Amsterdam (HQ), Düsseldorf HPE Growth Capital (“HPE”) is a technology growth equity specialist targeting investments in high-growth firms (c. 50 – 250 employees) in Northern Europe, with an emphasis on Germany and the Benelux. Founded 2010 Wetypically invest between €10m and €30m per investment in exchange for a significant minority stake. HPE has the ability to invest in both primary and secondary capital but has a strong preference for deals driven by a 10 investment professionals and need for primary capital to be used as catalyst for expansion. Employees 10 industry advisors Through our investments in fast growing profitable technology companies we seek to become active partners of our portfolio companies with the objective to accelerate growth and create future market leaders through Current Fund Size c. €100m (first close) internationalization, expansion of sales and marketing, operational excellence and buy-and-build. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt c. €260m • Big Data online credit scoring and loan underwriting • Fast, convenient, and responsible credit available from anywhere, at any time and Target Investment Size €10m–€30m from any device Northern Europe (emphasis on Germany & • European provider of alternative online payment solutions and e-money services Target Geographies Benelux) • FCA regulated e-money institution active in acquiring, issuing & processing Target Sectors Technology • Game-changer in the design, qualification and production of fully bonded spoolable thermoplastic composite pipes for the deepwater offshore oil & gas industry • Unique deployment characteristics and blue-chip customer base Investment Style Active Full Portfolio • www.hpegrowthcapital.com/portfolio.html Deal structures Significant minority stakes KEY CONTACTS Proven technology & business model Strong traction & growth potential • Manfred Krikke • 16 years of technology industry experience in Silicon Key Investment Criteria Outstanding management team • Partner Valley, including investment banking, growth equity Minimum MRR of €500k or investing and operations revenue of €10m • Email: • Companies: Kreditech, AOG mkrikke@hpegrowthcapital.com Website www.hpegrowthcapital.com • Jonne de Leeuw • 4 years of technology investing experience at Dasym Contact Email info@hpegrowthcapital.com • Vice President Investments and HPE Growth Capital • Email: • Companies: Kreditech Contact Phone +31 (0) 20 714 34 00 jdeleeuw@hpegrowthcapital.com

NOAH15 London Fund Book Page 63 Page 65

NOAH15 London Fund Book Page 63 Page 65