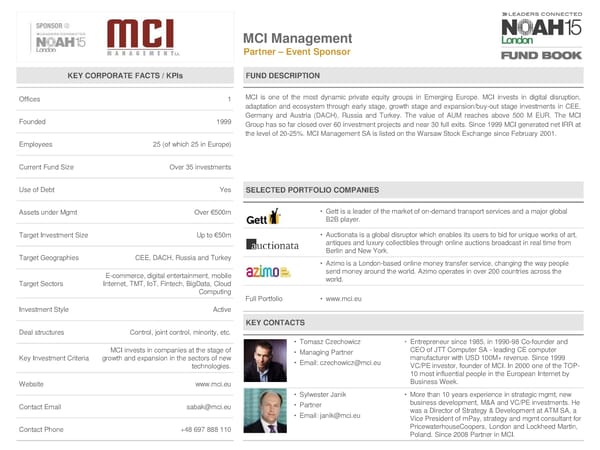

MCI Management Partner – Event Sponsor KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 MCI is one of the most dynamic private equity groups in Emerging Europe. MCI invests in digital disruption, adaptation and ecosystem through early stage, growth stage and expansion/buy-out stage investments in CEE, Founded 1999 Germany and Austria (DACH), Russia and Turkey. The value of AUM reaches above 500 M EUR. The MCI Group has so far closed over 60 investment projects and near 30 full exits. Since 1999 MCI generated net IRR at the level of 20-25%. MCI Management SA is listed on the Warsaw Stock Exchange since February 2001. Employees 25 (of which 25 in Europe) Current Fund Size Over 35 investments Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt Over €500m • Gett is a leader of the market of on-demand transport services and a major global B2B player. Target Investment Size Up to €50m • Auctionata is a global disruptor which enables its users to bid for unique works of art, antiques and luxury collectibles through online auctions broadcast in real time from Berlin and New York. Target Geographies CEE, DACH, Russia and Turkey • Azimois a London-based online money transfer service, changing the way people E-commerce,digital entertainment, mobile send money around the world. Azimo operates in over 200 countries across the Target Sectors Internet, TMT, IoT, Fintech, BigData, Cloud world. Computing Full Portfolio • www.mci.eu Investment Style Active KEY CONTACTS Deal structures Control, joint control, minority, etc. • Tomasz Czechowicz • Entrepreneur since 1985, in 1990-98 Co-founder and MCI invests in companies at the stage of • Managing Partner CEO of JTT Computer SA - leading CE computer Key Investment Criteria growth and expansion in the sectors of new • Email: [email protected] manufacturer with USD 100M+ revenue. Since 1999 technologies. VC/PE investor, founder of MCI. In 2000 one of the TOP- 10 most influential people in the European Internet by Website www.mci.eu Business Week. • Sylwester Janik • More than 10 years experience in strategic mgmt, new Contact Email [email protected] • Partner business development, M&A and VC/PE investments. He • Email: [email protected] was a Director of Strategy & Development at ATM SA, a Vice President of mPay, strategy and mgmtconsultant for Contact Phone +48 697 888 110 PricewaterhouseCoopers, London and Lockheed Martin, Poland. Since 2008 Partner in MCI.

NOAH15 London Fund Book Page 35 Page 37

NOAH15 London Fund Book Page 35 Page 37