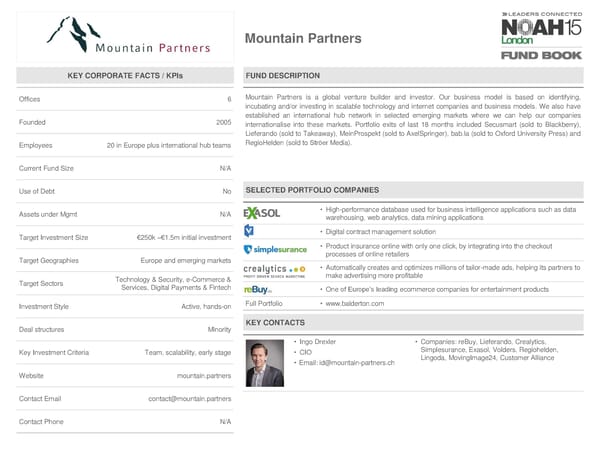

Mountain Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 6 Mountain Partners is a global venture builder and investor. Our business model is based on identifying, incubating and/or investing in scalable technology and internet companies and business models. We also have Founded 2005 established an international hub network in selected emerging markets where we can help our companies internationalise into these markets. Portfolio exits of last 18 months included Secusmart (sold to Blackberry), Lieferando (sold to Takeaway), MeinProspekt (sold to AxelSpringer), bab.la (sold to Oxford University Press) and Employees 20 in Europe plus international hub teams RegioHelden (sold to Ströer Media). Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • High-performance database used for business intelligence applications such as data warehousing, web analytics, data mining applications Target Investment Size €250k –€1.5m initial investment • Digital contract management solution • Product insurance online with only one click, by integrating into the checkout Target Geographies Europe and emerging markets processes of online retailers • Automatically creates and optimizes millions of tailor-made ads, helping its partners to Technology & Security, e-Commerce & make advertising more profitable Target Sectors Services, Digital Payments & Fintech • One of Europe’s leading ecommerce companies for entertainment products Investment Style Active, hands-on Full Portfolio • www.balderton.com Deal structures Minority KEY CONTACTS • Ingo Drexler • Companies: reBuy, Lieferando, Crealytics, Key Investment Criteria Team, scalability, early stage • CIO Simplesurance, Exasol, Volders, Regiohelden, • Email: [email protected] Lingoda, MovingImage24, Customer Alliance Website mountain.partners Contact Email [email protected] Contact Phone N/A

NOAH15 London Fund Book Page 36 Page 38

NOAH15 London Fund Book Page 36 Page 38