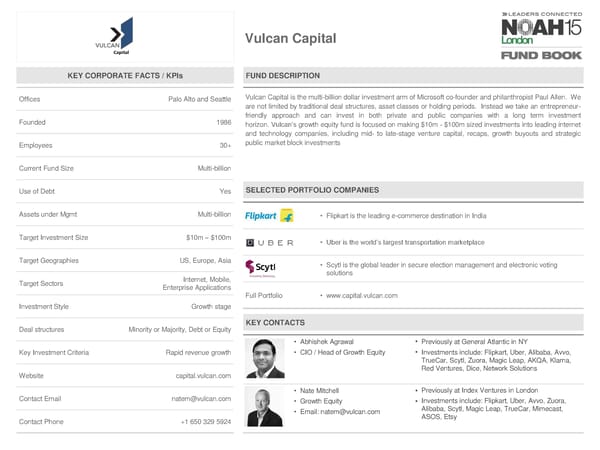

Vulcan Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Palo Alto and Seattle Vulcan Capital is the multi-billion dollar investment arm of Microsoft co-founder and philanthropist Paul Allen. We are not limited by traditional deal structures, asset classes or holding periods. Instead we take an entrepreneur- Founded 1986 friendly approach and can invest in both private and public companies with a long term investment horizon. Vulcan’s growth equity fund is focused on making $10m ‐ $100m sized investments into leading internet and technology companies, including mid‐ to late‐stage venture capital, recaps, growth buyouts and strategic Employees 30+ public market block investments Current Fund Size Multi-billion Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt Multi-billion • Flipkart is the leading e-commerce destination in India Target Investment Size $10m–$100m • Uber is the world’s largest transportation marketplace Target Geographies US, Europe, Asia • Scytl is the global leader in secure election management and electronic voting Internet, Mobile, solutions Target Sectors Enterprise Applications Full Portfolio • www.capital.vulcan.com Investment Style Growth stage Deal structures Minority or Majority, Debt or Equity KEY CONTACTS • Abhishek Agrawal • Previously at General Atlantic in NY Key Investment Criteria Rapid revenue growth • CIO / Head of Growth Equity • Investments include: Flipkart, Uber, Alibaba, Avvo, TrueCar, Scytl, Zuora, Magic Leap, AKQA, Klarna, Red Ventures, Dice, Network Solutions Website capital.vulcan.com • Nate Mitchell Previously at Index Ventures in London • Contact Email [email protected] • Growth Equity Investments include: Flipkart, Uber, Avvo, Zuora, • • Email: [email protected] Alibaba, Scytl, Magic Leap, TrueCar, Mimecast, Contact Phone +1 650 329 5924 ASOS, Etsy

NOAH15 London Fund Book Page 73 Page 75

NOAH15 London Fund Book Page 73 Page 75