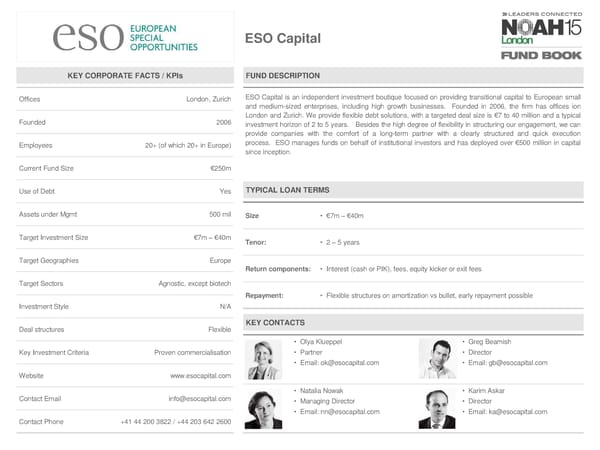

ESO Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Zurich ESOCapital is an independent investment boutique focused on providing transitional capital to European small and medium-sized enterprises, including high growth businesses. Founded in 2006, the firm has offices ion Founded 2006 London and Zurich. We provide flexible debt solutions, with a targeted deal size is €7 to 40 million and a typical investment horizon of 2 to 5 years. Besides the high degree of flexibility in structuring our engagement, we can provide companies with the comfort of a long-term partner with a clearly structured and quick execution Employees 20+ (of which 20+ in Europe) process. ESO manages funds on behalf of institutional investors and has deployed over €500 million in capital since inception. Current Fund Size €250m Use of Debt Yes TYPICAL LOAN TERMS Assets under Mgmt 500 mil Size • €7m – €40m Target Investment Size €7m–€40m Tenor: • 2 – 5 years Target Geographies Europe Return components: • Interest (cash or PIK), fees, equity kicker or exit fees Target Sectors Agnostic, except biotech Repayment: • Flexible structures on amortization vs bullet, early repayment possible Investment Style N/A Deal structures Flexible KEY CONTACTS • Olya Klueppel • Greg Beamish Key Investment Criteria Proven commercialisation • Partner • Director • Email: [email protected] • Email: [email protected] Website www.esocapital.com • Natalia Nowak • Karim Askar Contact Email [email protected] • Managing Director • Director • Email: [email protected] • Email: [email protected] Contact Phone +41 44 200 3822 / +44 203 642 2600

NOAH15 London Fund Book Page 85 Page 87

NOAH15 London Fund Book Page 85 Page 87