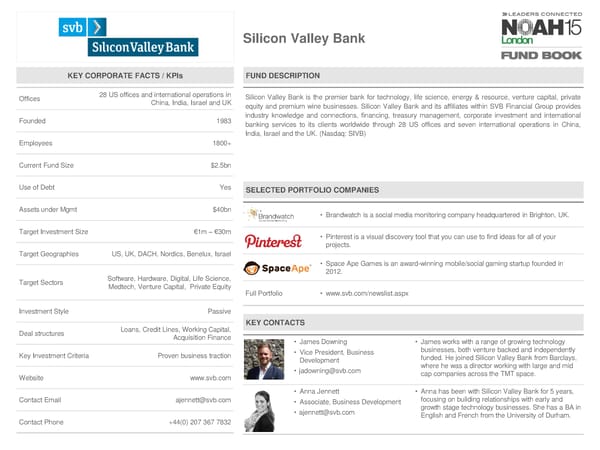

Silicon Valley Bank KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 28 US offices and international operations in Silicon Valley Bank is the premier bank for technology, life science, energy & resource, venture capital, private China, India, Israel and UK equity and premium wine businesses. Silicon Valley Bank and its affiliates within SVB Financial Group provides Founded 1983 industry knowledge and connections, financing, treasury management, corporate investment and international banking services to its clients worldwide through 28 US offices and seven international operations in China, India, Israel and the UK. (Nasdaq: SIVB) Employees 1800+ Current Fund Size $2.5bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt $40bn • Brandwatch is a social media monitoring company headquartered in Brighton, UK. Target Investment Size €1m – €30m • Pinterest is a visual discovery tool that you can use to find ideas for all of your projects. Target Geographies US, UK, DACH, Nordics, Benelux, Israel • Space Ape Games is an award-winning mobile/social gaming startup founded in 2012. Target Sectors Software, Hardware, Digital, Life Science, Medtech, Venture Capital, Private Equity Full Portfolio • www.svb.com/newslist.aspx Investment Style Passive Loans, Credit Lines, Working Capital, KEY CONTACTS Deal structures Acquisition Finance • James Downing • James works with a range of growing technology Key Investment Criteria Proven business traction • Vice President, Business businesses, both venture backed and independently Development funded. He joined Silicon Valley Bank from Barclays, • [email protected] where he was a director working with large and mid Website www.svb.com cap companies across the TMT space. • Anna Jennett • Anna has been with Silicon Valley Bank for 5 years, Contact Email [email protected] • Associate, Business Development focusing on building relationships with early and • [email protected] growth stage technology businesses. She has a BA in Contact Phone +44(0) 207 367 7832 English and French from the University of Durham.

NOAH15 London Fund Book Page 86 Page 88

NOAH15 London Fund Book Page 86 Page 88