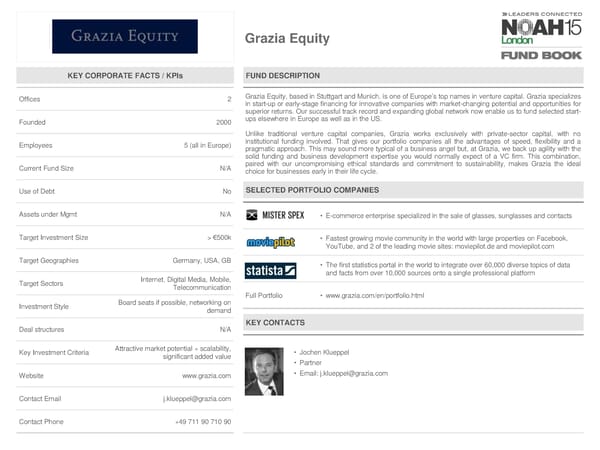

Grazia Equity KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 2 Grazia Equity, based in Stuttgart and Munich, is one of Europe’s top names in venture capital. Grazia specializes in start-up or early-stage financing for innovative companies with market-changing potential and opportunities for superior returns. Our successful track record and expanding global network now enable us to fund selected start- Founded 2000 ups elsewhere in Europe as well as in the US. Unlike traditional venture capital companies, Grazia works exclusively with private-sector capital, with no Employees 5 (all in Europe) institutional funding involved. That gives our portfolio companies all the advantages of speed, flexibility and a pragmatic approach. This may sound more typical of a business angel but, at Grazia, we back up agility with the solid funding and business development expertise you would normally expect of a VC firm. This combination, Current Fund Size N/A paired with our uncompromising ethical standards and commitment to sustainability, makes Grazia the ideal choice for businesses early in their life cycle. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • E-commerce enterprise specialized in the sale of glasses, sunglasses and contacts Target Investment Size > €500k • Fastest growing movie community in the world with large properties on Facebook, YouTube, and 2 of the leading movie sites: moviepilot.de and moviepilot.com Target Geographies Germany, USA, GB • The first statistics portal in the world to integrate over 60,000 diverse topics of data Internet, Digital Media, Mobile, and facts from over 10,000 sources onto a single professional platform Target Sectors Telecommunication Full Portfolio • www.grazia.com/en/portfolio.html Investment Style Board seats if possible, networking on demand Deal structures N/A KEY CONTACTS Key Investment Criteria Attractive market potential + scalability, • Jochen Klueppel significant added value • Partner Website www.grazia.com • Email: [email protected] Contact Email [email protected] Contact Phone +49 711 90 710 90

NOAH15 London Fund Book Page 24 Page 26

NOAH15 London Fund Book Page 24 Page 26