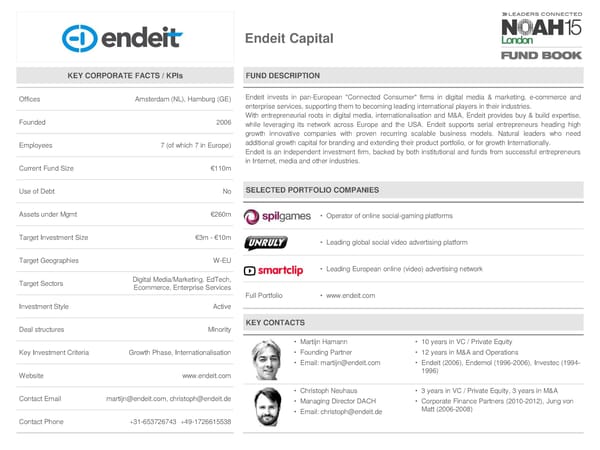

Endeit Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Amsterdam(NL), Hamburg (GE) Endeit invests in pan-European "Connected Consumer" firms in digital media & marketing, e-commerce and enterprise services, supporting them to becoming leading international players in their industries. Founded 2006 With entrepreneurial roots in digital media, internationalisation and M&A, Endeit provides buy & build expertise, while leveraging its network across Europe and the USA. Endeit supports serial entrepreneurs heading high growth innovative companies with proven recurring scalable business models. Natural leaders who need Employees 7 (of which 7 in Europe) additional growth capital for branding and extending their product portfolio, or for growth Internationally. Endeit is an independent investment firm, backed by both institutional and funds from successful entrepreneurs in Internet, media and other industries. Current Fund Size €110m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €260m • Operator of online social-gaming platforms Target Investment Size €3m-€10m • Leading global social video advertising platform Target Geographies W-EU • Leading European online (video) advertising network Target Sectors Digital Media/Marketing, EdTech, Ecommerce, Enterprise Services Full Portfolio • www.endeit.com Investment Style Active Deal structures Minority KEY CONTACTS • Martijn Hamann • 10 years in VC / Private Equity Key Investment Criteria Growth Phase, Internationalisation • Founding Partner • 12 years in M&A and Operations • Email: [email protected] • Endeit (2006), Endemol (1996-2006), Investec (1994- Website www.endeit.com 1996) • Christoph Neuhaus • 3 years in VC / Private Equity, 3 years in M&A Contact Email [email protected],[email protected] • Managing Director DACH • Corporate Finance Partners (2010-2012), Jung von • Email: [email protected] Matt (2006-2008) Contact Phone +31-653726743 +49-1726615538

NOAH15 London Fund Book Page 20 Page 22

NOAH15 London Fund Book Page 20 Page 22