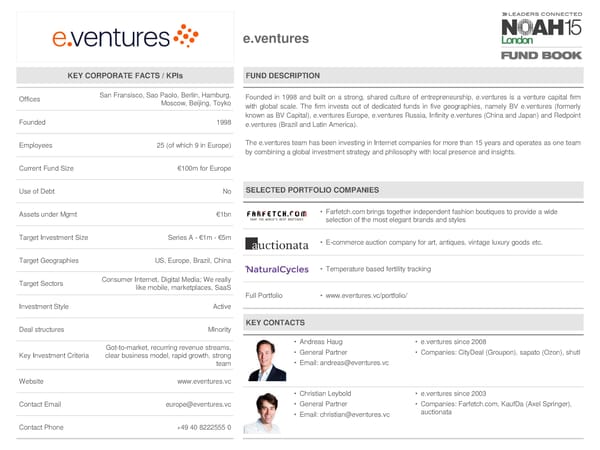

e.ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices SanFransisco, Sao Paolo, Berlin, Hamburg, Founded in 1998 and built on a strong, shared culture of entrepreneurship, e.ventures is a venture capital firm Moscow, Beijing, Toyko with global scale. The firm invests out of dedicated funds in five geographies, namely BV e.ventures (formerly Founded 1998 knownasBVCapital), e.ventures Europe, e.ventures Russia, Infinity e.ventures (China and Japan) and Redpoint e.ventures (Brazil and Latin America). Employees 25 (of which 9 in Europe) Thee.ventures team has been investing in Internet companies for more than 15 years and operates as one team by combining a global investment strategy and philosophy with local presence and insights. Current Fund Size €100m for Europe Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €1bn • Farfetch.com brings together independent fashion boutiques to provide a wide selection of the most elegant brands and styles Target Investment Size Series A - €1m - €5m • E-commerce auction company for art, antiques, vintage luxury goods etc. Target Geographies US, Europe, Brazil, China • Temperature based fertility tracking Target Sectors Consumer Internet, Digital Media; We really like mobile, marketplaces, SaaS Full Portfolio • www.eventures.vc/portfolio/ Investment Style Active Deal structures Minority KEY CONTACTS Got-to-market, recurring revenue streams, • Andreas Haug • e.ventures since 2008 Key Investment Criteria clear business model, rapid growth, strong • General Partner • Companies: CityDeal (Groupon), sapato (Ozon), shutl team • Email: [email protected] Website www.eventures.vc • Christian Leybold • e.ventures since 2003 Contact Email [email protected] • General Partner • Companies: Farfetch.com, KaufDa (Axel Springer), • Email: [email protected] auctionata Contact Phone +4940 8222555 0

NOAH15 London Fund Book Page 21 Page 23

NOAH15 London Fund Book Page 21 Page 23