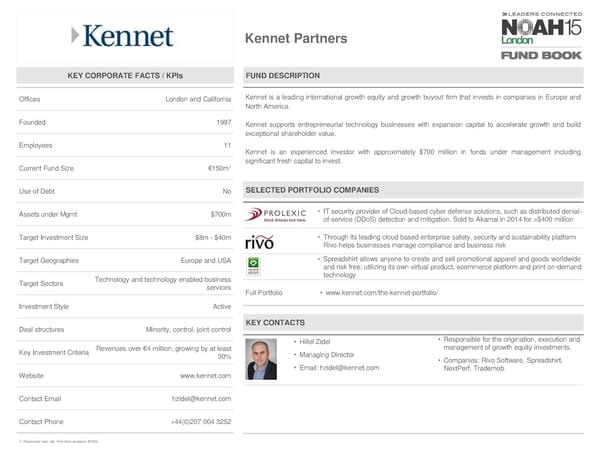

Kennet Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London and California Kennet is a leading international growth equity and growth buyout firm that invests in companies in Europe and North America. Founded 1997 Kennet supports entrepreneurial technology businesses with expansion capital to accelerate growth and build exceptional shareholder value. Employees 11 Kennet is an experienced investor with approximately $700 million in funds under management including significant fresh capital to invest. Current Fund Size €150m1 Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $700m • IT security provider of Cloud-based cyber defense solutions, such as distributed denial- of-service (DDoS) detection and mitigation. Sold to Akamai in 2014 for >$400 million Target Investment Size $8m - $40m • Through its leading cloud based enterprise safety, security and sustainability platform Rivo helps businesses manage compliance and business risk Target Geographies Europe and USA • Spreadshirt allows anyone to create and sell promotional apparel and goods worldwide and risk free; utilizing its own virtual product, ecommerce platform and print on-demand Technology and technology enabled business technology Target Sectors services Full Portfolio • www.kennet.com/the-kennet-portfolio/ Investment Style Active Deal structures Minority, control, joint control KEY CONTACTS • Hillel Zidel • Responsible for the origination, execution and Key Investment Criteria Revenues over €4 million, growing by at least management of growth equity investments. 30% • Managing Director • Companies: Rivo Software, Spreadshirt, • Email: [email protected] NextPerf, Trademob. Website www.kennet.com Contact Email [email protected] Contact Phone +44(0)207 004 3252 1- Represents hard cap. First close at approx €100m

NOAH15 London Fund Book Page 65 Page 67

NOAH15 London Fund Book Page 65 Page 67