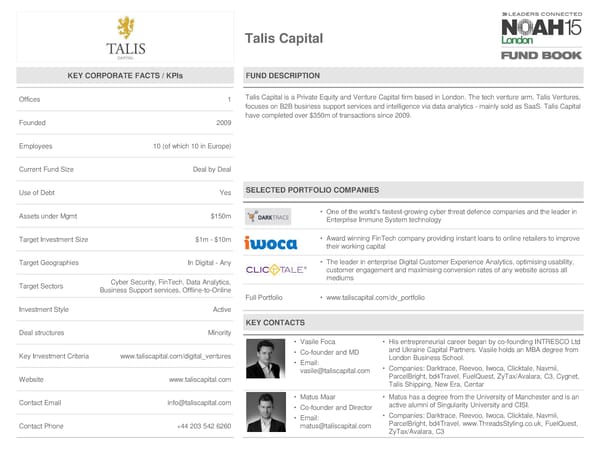

Talis Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 Talis Capital is a Private Equity and Venture Capital firm based in London. The tech venture arm, Talis Ventures, focuses on B2B business support services and intelligence via data analytics - mainly sold as SaaS. Talis Capital have completed over $350m of transactions since 2009. Founded 2009 Employees 10 (of which 10 in Europe) Current Fund Size Deal by Deal Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt $150m • One of the world’s fastest-growing cyber threat defence companies and the leader in Enterprise Immune System technology Target Investment Size $1m - $10m • Award winning FinTech company providing instant loans to online retailers to improve their working capital Target Geographies In Digital - Any • The leader in enterprise Digital Customer Experience Analytics, optimising usability, customer engagement and maximising conversion rates of any website across all Cyber Security, FinTech, Data Analytics, mediums Target Sectors Business Support services, Offline-to-Online Full Portfolio • www.taliscapital.com/dv_portfolio Investment Style Active KEY CONTACTS Deal structures Minority • Vasile Foca • His entrepreneurial career began by co-founding INTRESCO Ltd Key Investment Criteria www.taliscapital.com/digital_ventures • Co-founder and MD and Ukraine Capital Partners. Vasile holds an MBA degree from • Email: London Business School. [email protected] • Companies: Darktrace, Reevoo, Iwoca, Clicktale, Navmii, Website www.taliscapital.com ParcelBright, bd4Travel, FuelQuest, ZyTax/Avalara, C3, Cygnet, Talis Shipping, New Era, Centar Contact Email [email protected] • Matus Maar • Matus has a degree from the University of Manchester and is an • Co-founder and Director active alumni of Singularity University and CISI. • Email: • Companies: Darktrace, Reevoo, Iwoca, Clicktale, Navmii, Contact Phone +44 203 542 6260 [email protected] ParcelBright, bd4Travel, www.ThreadsStyling.co.uk, FuelQuest, ZyTax/Avalara, C3

NOAH15 London Fund Book Page 48 Page 50

NOAH15 London Fund Book Page 48 Page 50