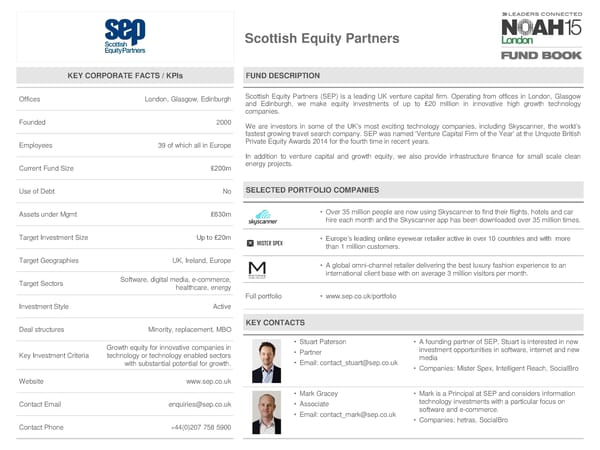

Scottish Equity Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Glasgow, Edinburgh Scottish Equity Partners (SEP) is a leading UK venture capital firm. Operating from offices in London, Glasgow and Edinburgh, we make equity investments of up to £20 million in innovative high growth technology companies. Founded 2000 Weare investors in some of the UK’s most exciting technology companies, including Skyscanner, the world’s fastest growing travel search company. SEP was named 'Venture Capital Firm of the Year' at the Unquote British Employees 39 of which all in Europe Private Equity Awards 2014 for the fourth time in recent years. In addition to venture capital and growth equity, we also provide infrastructure finance for small scale clean Current Fund Size £200m energy projects. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt £630m • Over 35 million people are now using Skyscanner to find their flights, hotels and car hire each month and the Skyscanner app has been downloaded over 35 million times. Target Investment Size Up to £20m • Europe’s leading online eyewear retailer active in over 10 countries and with more than 1 million customers. Target Geographies UK,Ireland, Europe • A global omni-channel retailer delivering the best luxury fashion experience to an Software, digital media, e-commerce, international client base with on average 3 million visitors per month. Target Sectors healthcare, energy Full portfolio • www.sep.co.uk/portfolio Investment Style Active Deal structures Minority, replacement, MBO KEY CONTACTS Growth equity for innovative companies in • Stuart Paterson • A founding partner of SEP, Stuart is interested in new Key Investment Criteria technology or technology enabled sectors • Partner investment opportunities in software, internet and new with substantial potential for growth. • Email: [email protected] media • Companies: Mister Spex, Intelligent Reach, SocialBro Website www.sep.co.uk • Mark Gracey • Mark is a Principal at SEP and considers information Contact Email [email protected] • Associate technology investments with a particular focus on • Email: [email protected] software and e-commerce. • Companies: hetras, SocialBro Contact Phone +44(0)207 758 5900

NOAH15 London Fund Book Page 47 Page 49

NOAH15 London Fund Book Page 47 Page 49