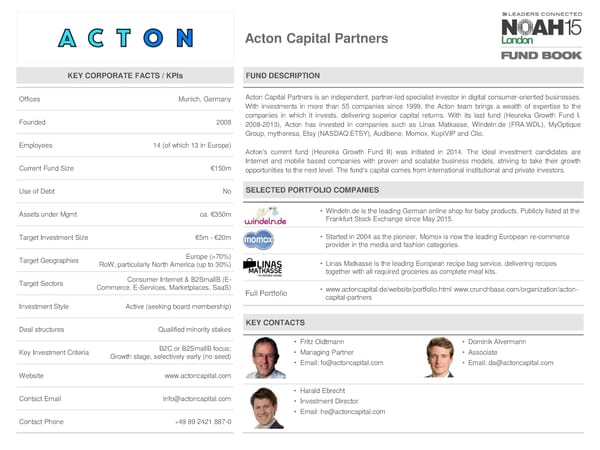

Acton Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Munich, Germany Acton Capital Partners is an independent, partner-led specialist investor in digital consumer-oriented businesses. With investments in more than 55 companies since 1999, the Acton team brings a wealth of expertise to the Founded 2008 companies in which it invests, delivering superior capital returns. With its last fund (Heureka Growth Fund I, 2008-2013), Acton has invested in companies such as Linas Matkasse, Windeln.de (FRA:WDL), MyOptique Group, mytheresa, Etsy (NASDAQ:ETSY),Audibene, Momox, KupiVIP and Clio. Employees 14 (of which 13 in Europe) Acton’s current fund (Heureka Growth Fund II) was initiated in 2014. The ideal investment candidates are Internet and mobile based companies with proven and scalable business models, striving to take their growth Current Fund Size €150m opportunities to the next level. The fund’s capital comes from international institutional and private investors. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt ca. €350m • Windeln.de is the leading German online shop for baby products. Publicly listed at the Frankfurt Stock Exchange since May 2015. Target Investment Size €5m-€20m • Started in 2004 as the pioneer, Momox is now the leading European re-commerce provider in the media and fashion categories. Target Geographies Europe (>70%) RoW, particularly North America (up to 30%) • Linas Matkasse is the leading European recipe bag service, delivering recipes together with all required groceries as complete meal kits. Target Sectors Consumer Internet & B2SmallB (E- Commerce,E-Services, Marketplaces, SaaS) Full Portfolio • www.actoncapital.de/website/portfolio.html www.crunchbase.com/organization/acton- capital-partners Investment Style Active (seeking board membership) Deal structures Qualified minority stakes KEY CONTACTS B2C or B2SmallB focus; • Fritz Oidtmann • Dominik Alvermann Key Investment Criteria Growth stage, selectively early (no seed) • Managing Partner • Associate • Email: [email protected] • Email: [email protected] Website www.actoncapital.com • Harald Ebrecht Contact Email [email protected] • Investment Director • Email: [email protected] Contact Phone +49 89 2421 887-0

NOAH15 London Fund Book Page 8 Page 10

NOAH15 London Fund Book Page 8 Page 10