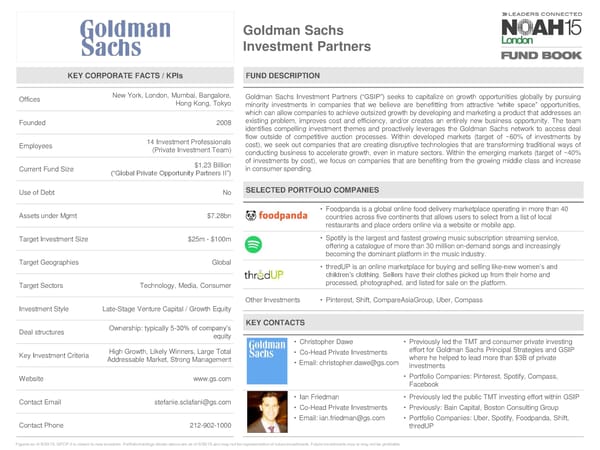

Goldman Sachs Investment Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices New York, London, Mumbai, Bangalore, Goldman Sachs Investment Partners (“GSIP”) seeks to capitalize on growth opportunities globally by pursuing Hong Kong, Tokyo minority investments in companies that we believe are benefitting from attractive “white space” opportunities, which can allow companies to achieve outsized growth by developing and marketing a product that addresses an Founded 2008 existing problem, improves cost and efficiency, and/or creates an entirely new business opportunity. The team identifies compelling investment themes and proactively leverages the Goldman Sachs network to access deal 14 Investment Professionals flow outside of competitive auction processes. Within developed markets (target of ~60% of investments by Employees (Private Investment Team) cost), we seek out companies that are creating disruptive technologies that are transforming traditional ways of conducting business to accelerate growth, even in mature sectors. Within the emerging markets (target of ~40% $1,23 Billion of investments by cost), we focus on companies that are benefiting from the growing middle class and increase Current Fund Size in consumer spending. (“Global Private Opportunity Partners II”) Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $7.28bn • Foodpanda is a global online food delivery marketplace operating in more than 40 countries across five continents that allows users to select from a list of local restaurants and place orders online via a website or mobile app. Target Investment Size $25m - $100m • Spotify is the largest and fastest growing music subscription streaming service, offering a catalogue of more than 30 million on-demand songs and increasingly becoming the dominant platform in the music industry. Target Geographies Global • thredUP is an online marketplace for buying and selling like-new women’s and children’s clothing. Sellers have their clothes picked up from their home and Target Sectors Technology, Media, Consumer processed, photographed, and listed for sale on the platform. Other Investments • Pinterest, Shift, CompareAsiaGroup, Uber, Compass Investment Style Late-Stage Venture Capital / Growth Equity Ownership: typically 5-30% of company’s KEY CONTACTS Deal structures equity • Christopher Dawe • Previously led the TMT and consumer private investing Key Investment Criteria High Growth, Likely Winners, Large Total • Co-Head Private Investments effort for Goldman Sachs Principal Strategies and GSIP Addressable Market, Strong Management • Email: [email protected] where he helped to lead more than $3B of private investments Website www.gs.com • Portfolio Companies: Pinterest, Spotify, Compass, Facebook Contact Email [email protected] • Ian Friedman • Previously led the public TMT investing effort within GSIP • Co-Head Private Investments • Previously: Bain Capital, Boston Consulting Group • Email: [email protected] • Portfolio Companies: Uber, Spotify, Foodpanda, Shift, Contact Phone 212-902-1000 thredUP Figures as of 9/30/15. GPOP II is closed to new investors. Portfolio holdings shown above are as of 9/30/15 and may not be representative of future investments. Future investments may or may not be profitable.

NOAH15 London Fund Book Page 61 Page 63

NOAH15 London Fund Book Page 61 Page 63