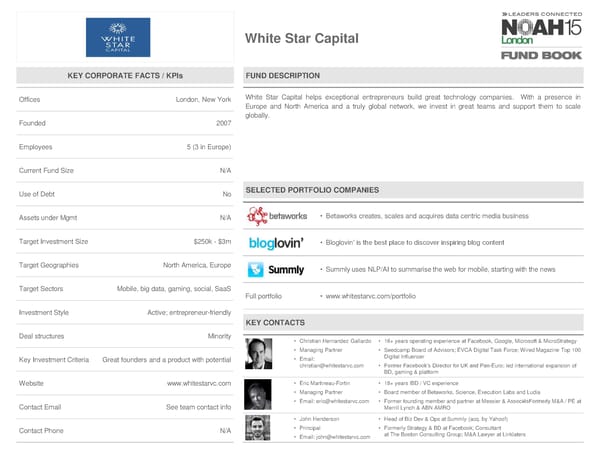

White Star Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, New York White Star Capital helps exceptional entrepreneurs build great technology companies. With a presence in Europe and North America and a truly global network, we invest in great teams and support them to scale globally. Founded 2007 Employees 5 (3 in Europe) Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Betaworks creates, scales and acquires data centric media business Target Investment Size $250k - $3m • Bloglovin’ is the best place to discover inspiring blog content Target Geographies North America, Europe • Summly uses NLP/AI to summarise the web for mobile, starting with the news Target Sectors Mobile, big data, gaming, social, SaaS Full portfolio • www.whitestarvc.com/portfolio Investment Style Active; entrepreneur-friendly KEY CONTACTS Deal structures Minority • Christian Hernandez Gallardo • 16+ years operating experience at Facebook, Google, Microsoft & MicroStrategy • Managing Partner • Seedcamp Board of Advisors; EVCA Digital Task Force; Wired Magazine Top 100 Key Investment Criteria Great founders and a product with potential • Email: Digital Influencer [email protected] • Former Facebook’s Director for UK and Pan-Euro; led international expansion of BD, gaming & platform Website www.whitestarvc.com • Eric Martineau-Fortin • 18+ years IBD / VC experience • Managing Partner • Board member of Betaworks, Science, Execution Labs and Ludia Contact Email See team contact info • Email: [email protected] • Former founding member and partner at Messier & AssociésFormerly M&A / PE at Merrill Lynch & ABN AMRO • John Henderson • Head of Biz Dev & Ops at Summly (acq. by Yahoo!) Contact Phone N/A • Principal • Formerly Strategy & BD at Facebook; Consultant • Email: [email protected] at The Boston Consulting Group; M&A Lawyer at Linklaters

NOAH15 London Fund Book Page 54 Page 56

NOAH15 London Fund Book Page 54 Page 56