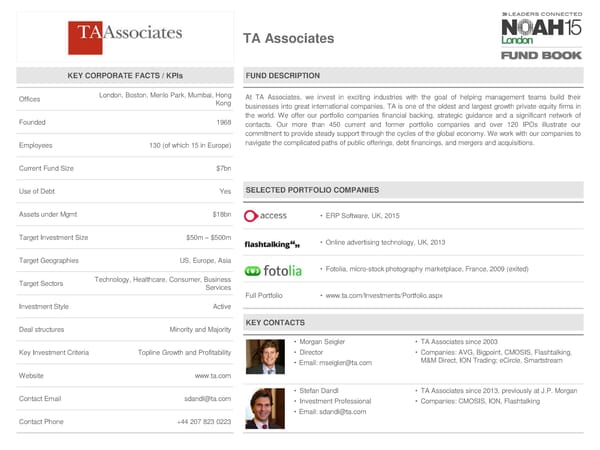

TA Associates KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Boston, Menlo Park, Mumbai, Hong At TA Associates, we invest in exciting industries with the goal of helping management teams build their Kong businesses into great international companies. TA is one of the oldest and largest growth private equity firms in Founded 1968 the world. We offer our portfolio companies financial backing, strategic guidance and a significant network of contacts. Our more than 450 current and former portfolio companies and over 120 IPOs illustrate our commitment to provide steady support through the cycles of the global economy. We work with our companies to Employees 130 (of which 15 in Europe) navigate the complicated paths of public offerings, debt financings, and mergers and acquisitions. Current Fund Size $7bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt $18bn • ERP Software, UK, 2015 Target Investment Size $50m – $500m • Online advertising technology, UK, 2013 Target Geographies US,Europe, Asia • Fotolia, micro-stock photography marketplace, France, 2009 (exited) Target Sectors Technology, Healthcare, Consumer, Business Services Full Portfolio • www.ta.com/Investments/Portfolio.aspx Investment Style Active Deal structures Minority and Majority KEY CONTACTS • Morgan Seigler • TA Associates since 2003 Key Investment Criteria Topline Growth and Profitability • Director • Companies: AVG, Bigpoint, CMOSIS, Flashtalking, • Email: [email protected] M&M Direct, ION Trading; eCircle, Smartstream Website www.ta.com • Stefan Dandl • TA Associates since 2013, previously at J.P. Morgan Contact Email [email protected] • Investment Professional • Companies: CMOSIS, ION, Flashtalking • Email: [email protected] Contact Phone +44207 823 0223

NOAH15 London Fund Book Page 71 Page 73

NOAH15 London Fund Book Page 71 Page 73