NOAH 2016 London Investor Book

The industry reference covering all stages of the investment spectrum - specifically internet companies seeking investment.

INVESTOR BOOK EDITION OCTOBER 2016

Table of Contents Program 3 Venture Capital 8 Growth 72 Debt 89 Buyout 92

10 -11 November 2016 Old Billingsgate PROGRAM Strategic Partners Premium Partners

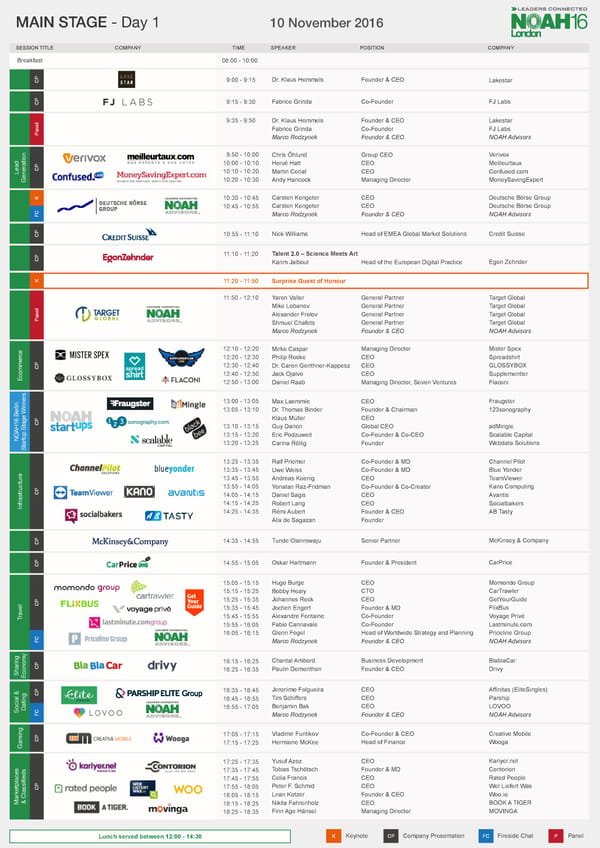

MAIN STAGE - Day 1 10 November 2016 SESSION TITLE COMPANY TIME SPEAKER POSITION COMPANY Breakfast 08:00 - 10:00 CP 9:00 - 9:15 Dr. Klaus Hommels Founder & CEO Lakestar CP 9:15 - 9:30 Fabrice Grinda Co-Founder FJ Labs 9:35 - 9:50 Dr. Klaus Hommels Founder & CEO Lakestar Panel Fabrice Grinda Co-Founder FJ Labs Marco Rodzynek Founder & CEO NOAH Advisors 9:50 - 10:00 Chris Öhlund Group CEO Verivox 10:00 - 10:10 Hervé Hatt CEO Meilleurtaux Lead CP 10:10 - 10:20 Martin Coriat CEO Confused.com Generation 10:20 - 10:30 Andy Hancock Managing Director MoneySavingExpert K 10:30 - 10:45 Carsten Kengeter CEO Deutsche Börse Group 10:45 - 10:55 Carsten Kengeter CEO Deutsche Börse Group FC Marco Rodzynek Founder & CEO NOAH Advisors CP 10:55 - 11:10 Nick Williams Head of EMEA Global Market Solutions Credit Suisse 11:10 - 11:20 Talent 2.0 – Science Meets Art CP Karim Jalbout Head of the European Digital Practice Egon Zehnder K 11:20 - 11:50 Surprise Guest of Honour 11:50 - 12:10 Yaron Valler General Partner Target Global Mike Lobanov General Partner Target Global Panel Alexander Frolov General Partner Target Global Shmuel Chafets General Partner Target Global Marco Rodzynek Founder & CEO NOAH Advisors ce 12:10 - 12:20 Mirko Caspar Managing Director Mister Spex 12:20 - 12:30 Philip Rooke CEO Spreadshirt CP 12:30 - 12:40 Dr. Caren Genthner-Kappesz CEO GLOSSYBOX Ecommer 12:40 - 12:50 Jack Ojalvo CEO Supplementler 12:50 - 13:00 Daniel Raab Managing Director, Seven Ventures Flaconi 13:00 - 13:05 Max Laemmle CEO Fraugster 13:05 - 13:10 Dr. Thomas Binder Founder & Chairman 123sonography CP Klaus Müller CEO 13:10 - 13:15 Guy Danon Global CEO adMingle NOAH16 Berlin 13:15 - 13:20 Eric Podzuweit Co-Founder & Co-CEO Scalable Capital Startup Stage Winners 13:20 - 13:25 Carina Röllig Founder Webdata Solutions 13:25 - 13:35 Ralf Priemer Co-Founder & MD Channel Pilot e 13:35 - 13:45 Uwe Weiss Co-Founder & MD Blue Yonder 13:45 - 13:55 Andreas Koenig CEO TeamViewer 13:55 - 14:05 Yonatan Raz-Fridman Co-Founder & Co-Creator Kano Computing CP 14:05 - 14:15 Daniel Sagis CEO Avantis Infrastructur 14:15 - 14:25 Robert Lang CEO Socialbakers 14:25 - 14:35 Rémi Aubert Founder & CEO AB Tasty Alix de Sagazan Founder CP 14:35 - 14:55 Tunde Olanrewaju Senior Partner McKinsey & Company CP 14:55 - 15:05 Oskar Hartmann Founder & President CarPrice 15:05 - 15:15 Hugo Burge CEO Momondo Group 15:15 - 15:25 Bobby Healy CTO CarTrawler CP 15:25 - 15:35 Johannes Reck CEO GetYourGuide 15:35 - 15:45 Jochen Engert Founder & MD FlixBus ravel 15:45 - 15:55 Alexandre Fontaine Co-Founder Voyage Privé T 15:55 - 16:05 Fabio Cannavale Co-Founder Lastminute.com 16:05 - 16:15 Glenn Fogel Head of Worldwide Strategy and Planning Priceline Group FC Marco Rodzynek Founder & CEO NOAH Advisors 16:15 - 16:25 Chantal Ambord Business Development BlablaCar CP 16:25 - 16:35 Paulin Dementhon Founder & CEO Drivy SharingEconomy CP 16:35 - 16:45 Jeronimo Folgueira CEO Affinitas (EliteSingles) 16:45 - 16:55 Tim Schiffers CEO Parship Social & Dating 16:55 - 17:05 Benjamin Bak CEO LOVOO FC Marco Rodzynek Founder & CEO NOAH Advisors 17:05 - 17:15 Vladimir Funtikov Co-Founder & CEO Creative Mobile CP 17:15 - 17:25 Hermione McKee Head of Finance Wooga Gaming 17:25 - 17:35 Yusuf Azoz CEO Kariyer.net 17:35 - 17:45 Tobias Tschötsch Founder & MD Contorion 17:45 - 17:55 Celia Francis CEO Rated People CP 17:55 - 18:05 Peter F. Schmid CEO Wer Liefert Was 18:05 - 18:15 Liran Kotzer Founder & CEO Woo.io & Classifieds Marketplaces 18:15 - 18:25 Nikita Fahrenholz CEO BOOK A TIGER 18:25 - 18:35 Finn Age Hänsel Managing Director MOVINGA Lunch served between 12:00 - 14:30 K Keynote CP Company Presentation FC Fireside Chat P Panel

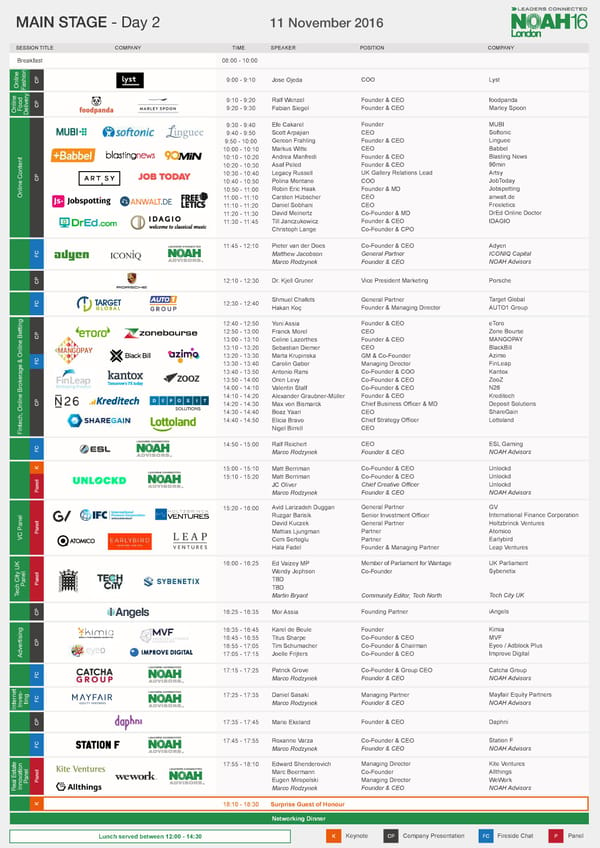

MAIN STAGE - Day 2 11 November 2016 SESSION TITLE COMPANY TIME SPEAKER POSITION COMPANY Breakfast 08:00 - 10:00 CP 9:00 - 9:10 Jose Ojeda COO Lyst OnlineFashion 9:10 - 9:20 Ralf Wenzel Founder & CEO foodpanda Online Food CP 9:20 - 9:30 Fabian Siegel Founder & CEO Marley Spoon Delivery 9:30 - 9:40 Efe Cakarel Founder MUBI 9:40 - 9:50 Scott Arpajian CEO Softonic 9:50 - 10:00 Gereon Frahling Founder & CEO Linguee 10:00 - 10:10 Markus Witte CEO Babbel 10:10 - 10:20 Andrea Manfredi Founder & CEO Blasting News 10:20 - 10:30 Asaf Peled Founder & CEO 90min 10:30 - 10:40 Legacy Russell UK Gallery Relations Lead Artsy CP 10:40 - 10:50 Polina Montano COO JobToday 10:50 - 11:00 Robin Eric Haak Founder & MD Jobspotting Online Content 11:00 - 11:10 Carsten Hübscher CEO anwalt.de 11:10 - 11:20 Daniel Sobhani CEO Freeletics 11:20 - 11:30 David Meinertz Co-Founder & MD DrEd Online Doctor 11:30 - 11:45 Till Janczukowicz Founder & CEO IDAGIO Christoph Lange Co-Founder & CPO 11:45 - 12:10 Pieter van der Does Co-Founder & CEO Adyen FC Matthew Jacobson General Partner ICONIQ Capital Marco Rodzynek Founder & CEO NOAH Advisors CP 12:10 - 12:30 Dr. Kjell Gruner Vice President Marketing Porsche 12:30 - 12:40 Shmuel Chafets General Partner Target Global FC Hakan Koç Founder & Managing Director AUTO1 Group 12:40 - 12:50 Yoni Assia Founder & CEO eToro 12:50 - 13:00 Franck Morel CEO Zone Bourse CP 13:00 - 13:10 Celine Lazorthes Founder & CEO MANGOPAY 13:10 - 13:20 Sebastian Diemer CEO BlackBill 13:20 - 13:30 Marta Krupinska GM & Co-Founder Azimo FC 13:30 - 13:40 Carolin Gabor Managing Director FinLeap 13:40 - 13:50 Antonio Rami Co-Founder & COO Kantox okerage & Online Betting 13:50 - 14:00 Oren Levy Co-Founder & CEO ZooZ 14:00 - 14:10 Valentin Stalf Co-Founder & CEO N26 14:10 - 14:20 Alexander Graubner-Müller Founder & CEO Kreditech CP 14:20 - 14:30 Max von Bismarck Chief Business Officer & MD Deposit Solutions 14:30 - 14:40 Boaz Yaari CEO ShareGain 14:40 - 14:50 Elicia Bravo Chief Strategy Officer Lottoland Fintech, Online Br Nigel Birrell CEO 14:50 - 15:00 Ralf Reichert CEO ESL Gaming FC Marco Rodzynek Founder & CEO NOAH Advisors K 15:00 - 15:10 Matt Berriman Co-Founder & CEO Unlockd 15:10 - 15:20 Matt Berriman Co-Founder & CEO Unlockd JC Oliver Chief Creative Officer Unlockd Panel Marco Rodzynek Founder & CEO NOAH Advisors 15:20 - 16:00 Avid Larizadeh Duggan General Partner GV Ruzgar Barisik Senior Investment Officer International Finance Corporation David Kuczek General Partner Holtzbrinck Ventures Panel Mattias Ljungman Partner Atomico VC Panel Cem Sertoglu Partner Earlybird Hala Fadel Founder & Managing Partner Leap Ventures 16:00 - 16:25 Ed Vaizey MP Member of Parliament for Wantage UK Parliament Wendy Jephson Co-Founder Sybenetix PanelPanel TBD ech City UK TBD T Martin Bryant Community Editor, Tech North Tech City UK CP 16:25 - 16:35 Mor Assia Founding Partner iAngels 16:35 - 16:45 Karel de Beule Founder Kimia 16:45 - 16:55 Titus Sharpe Co-Founder & CEO MVF CP 16:55 - 17:05 Tim Schumacher Co-Founder & Chairman Eyeo / Adblock Plus Advertising 17:05 - 17:15 Joelle Frijters Co-Founder & CEO Improve Digital 17:15 - 17:25 Patrick Grove Co-Founder & Group CEO Catcha Group FC Marco Rodzynek Founder & CEO NOAH Advisors net - 17:25 - 17:35 Daniel Sasaki Managing Partner Mayfair Equity Partners InvestingFC Marco Rodzynek Founder & CEO NOAH Advisors Inter CP 17:35 - 17:45 Marie Ekeland Founder & CEO Daphni 17:45 - 17:55 Roxanne Varza Co-Founder & CEO Station F FC Marco Rodzynek Founder & CEO NOAH Advisors 17:55 - 18:10 Edward Shenderovich Managing Director Kite Ventures Marc Beermann Co-Founder Allthings PanelPanel Eugen Miropolski Managing Director WeWork Real EstateInnovation Marco Rodzynek Founder & CEO NOAH Advisors K 18:10 - 18:30 Surprise Guest of Honour Networking Dinner Lunch served between 12:00 - 14:30 K Keynote CP Company Presentation FC Fireside Chat P Panel

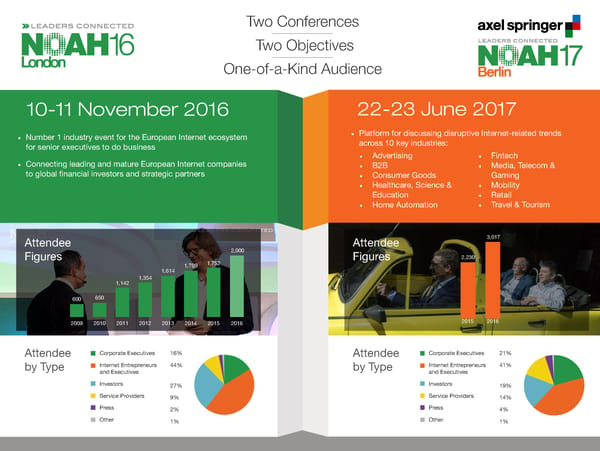

Two Conferences Two Objectives One-of-a-Kind Audience 10-11 November 2016 22-23 June 2017 • Number 1 industry event for the European Internet ecosystem • Platform for discussing disruptive Internet-related trends for senior executives to do business across 10 key industries: • Connecting leading and mature European Internet companies • Advertising • Fintech to global financial investors and strategic partners • B2B • Media, Telecom & • Consumer Goods Gaming • Healthcare, Science & • Mobility Education • Retail • Home Automation • Travel & Tourism Attendee Attendee 3,017 2,000 Figures 1,752 Figures 2,230 1,614 1,709 1,142 1,354 600 650 2009 2010 2011 2012 2013 2014 2015 2016 2015 2016 Attendee Corporate Executives 16% Attendee Corporate Executives 21% by Type Internet Entrepreneurs 44% by Type Internet Entrepreneurs 41% and Executives and Executives Investors 27% Investors 19% Service Providers 9% Service Providers 14% Press 2% Press 4% Other 1% Other 1%

NOAH Advisors provides corporate finance services to the digital sector in Europe Selected Completed NOAH Transactions October 2016 September 2016 May 2016 September 2015 July 2015 Investment in Acquisition of a Majority Stake in Investment in Sale of a 70% stake in Primary funding for by by by to from from 84% Ownership at a valuation of €300m Exclusive Financial Advisor to KäuferPortal Financial Advisor to Oakley Capital Exclusive Financial Advisor to Exclusive Financial Advisor to Advisor to BIScience and its Shareholders 10Bis and its Shareholders Drushim and its Shareholders December 2014 October 2014 September 2014 August 2014 May 2014 Sale of 100% of Sale of 100% of Sale of controlling stake in sold 100% of for $800m to for €80m to to sale to for $228m to a joint venture between Exclusive Financial Advisor to Exclusive Financial Advisor to Exclusive Financial Advisor to Advisor to the Selling Shareholders Exclusive Financial Advisor to Yad2 Fotolia and the Selling Shareholders Trovit and its Shareholders Facile.it and its Shareholders and its Shareholders February 2013 May 2012 April 2012 December 2011 November 2011 Sale of 100% in Sale of a majority stake in Fund raising for Growth equity investment from $150 million growth equity investment from to for a 30% stake for a 50% stake alongside Fotolia’s from various investors including to alongside Softonic’s Founders Founders and TA Associates Angel Investors and Angel Investors at a Additional $150 million senior Quants Financial Services AG valuation of €275m debt financing Exclusive Financial Advisor to Financial Advisor to Fotolia and Financial Advisor to Toprural Advisor to Work4 Labs Exclusive Financial Advisor to Softonic and its shareholders its Shareholders and its Shareholders grupfoni and its Shareholders

INVESTOR BOOK VENTURE CAPITAL

3TS Capital Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Bucharest, Budapest, Istanbul, Prague, 3TSCapital Partners is one of the leading private equity and venture capital firms in Central and Eastern Europe Vienna, Warsaw operating in the whole region through offices in Budapest, Bucharest, Istanbul, Prague, Vienna and Warsaw. 3TS targets investments in growth sectors including Technology & Internet (Software, Hardware, Mobile, Founded 1998 Ecommerce, Social, etc.), Media & Communications and Technology-Enabled Services (Consumer and Business Services, Healthcare Services, etc.). Investors in the current and earlier 3TS funds totalling over € 300 million include Cisco, EIF, EBRD, OTP, Sitra, 3i and KfW among others. Employees 14 (of which 14 in Europe) Current Fund Size More than €100m Use of Debt Flexible SELECTED PORTFOLIO COMPANIES AUM More than €300m Target Investment Size €300k - €15m Target Geographies Central and Eastern Europe Technology & Internet, Media & Target Sectors Communications,Technology-Enabled Services Full Portfolio • www.3tscapital.com/portfolio.html Investment Style Active, Board support KEY CONTACTS Deal Structures Significant Minority or Majority • Zbigniew Lapinski • Mr. Lapinski works in the Warsaw office and is Key Investment Criteria High growth Global Challengers, • Partner responsible for Polish investment sourcing, or Local Leaders • Email: [email protected] transactions and portfolio management. Website www.3tscapital.com Contact Email [email protected] Contact Phone + 43 1 4023679

Accel KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Palo Alto, New York, London, Bangalore Accel is a leading early and growth-stage venture capital firm, powering a global community of entrepreneurs. Accel backs entrepreneurs who have what it takes to build a world-class, category-defining business. Founded in 1983, Accel brings more than three decades of experience building and supporting hundreds of companies. Founded 1983 Accel's vision for entrepreneurship and business enables it to identify and invest in the companies that will be responsible for the growth of next-generation industries. Accel has backed a number of iconic global platforms, which are powering new experiences for mobile consumers and the modern enterprise, including Atlassian, Employees 52 investment professionals BlaBlaCar, Dropbox, Funding Circle, Etsy, Facebook, Flipkart, Funding Circle, Kayak, QlikTech, Simplivity, (of which 12 in Europe) Spotify, Slack, Supercell, World Remit and others. Current Fund Size $2.8bn across the US, Europe ($500m) and India Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $10bn+ • Largest global social network Target Investment Size $1m - $100m • Largest global music subscription service Target Geographies Global • Game studio behind among others Clash of Clans, highest ever grossing mobile app Target Sectors Technology and technology-enabled services Investment Style Active Full Portfolio • www.accel.com Deal Structures Minority KEY CONTACTS Exceptional entrepreneurs looking to build • Luciana Lixandru • CV: 10+ years technology investing, Georgetown Key Investment Criteria category-defining businesses • Principal University • Companies: Deliveroo, Carwow, Avito, Wallapop, Algolia, Doctolib, Vinted Website www.accel.com • Andrei Brasoveanu • CV: 5+ years technology investing and trading, Contact Email [email protected] • Investor Harvard Business School and Princeton • Companies: Celonis, Carto, JobToday Contact Phone +44 20 7170 1000

ACE & Company KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Geneva, London, Hong Kong, ACE was co-founded in 2005. Originally incubated by a single-family office, the firm now works in partnership New York, Cairo with many individual investors and leading institutions. Headquartered in Geneva, Switzerland, ACE & Company has operating offices and team members in New York, London, and Cairo, and Hong Kong. Founded 2005 Drawing from its broad private equity heritage, ACE is uniquely positioned to understand the needs and challenges facing private investors today. By leveraging the in-house capabilities with those of the global network Employees N/A of partners, the firm is able to source, diligence, and execute on superior investment opportunities. At the core of its philosophy, ACE strives to ensure alignment of interest of all parties by investing shareholder’s Current Fund Size N/A proprietary capital in all transaction and vehicles it undertakes. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Visual bookmarking tool for saving and discovering creative ideas Target Investment Size N/A • Money transfer service allowing private individuals and businesses to send money Target Geographies North America, Europa, Middle East abroad without hidden charges Technology, Consumer Service, Consumer • Mobile app connecting passengers with drivers for hire Target Sectors Goods, Business Services, Basic Resources, Financials, Industrials, Transportation, Marketplace, Fintech Full Portfolio • https://www.aceandcompany.com/portfolio/ Investment Style N/A KEY CONTACTS Deal Structures Minority or Majority • Charles Lorenceau Key Investment Criteria Technology-enabled companies • Managing Director in the target sector • Email: [email protected] Website www.aceandcompany.com Contact Email N/A Contact Phone +41 22 311 33 33

Acton Capital Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Munich Acton Capital Partners is a growth-stage venture capital firm, based in Munich. With investments in more than 65 companies since 1999, the Acton team brings a wealth of expertise and experience to the companies in which it invests, delivering superior capital returns. The ideal investment candidates are Internet companies in the Founded 1999 consumer or B2B-SaaS space with proven and scalable business models, striving to take their growth opportunities to the next level. Acton’s current fund was initiated in 2014 with a volume of €170m and has so far invested amongst others in Employees 14 (of which 13 in Europe) HomeToGo,Tictail, iwoca, GetSafe, Mambu, Mobify, Eloquii, Comatch, Finanzcheck.de and Chefs Plate. With its previous fund (vintage 2008), Acton had invested in companies such as Linas Matkasse, Windeln.de, MyOptique Group, mytheresa.com, Etsy, Audibene, Momox, KupiVIP and Clio. Before 2008, the Acton team had invested Current Fund Size €170m through the Burda Digital Ventures fund I and II in companies like Ciao, HolidayCheck, Zooplus, OnVista, Cyberport, AbeBooks and Alando. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €350m • HomeToGois an independent meta search engine for vacation rentals combining the models of enquiry and immediate booking. Based in Berlin. Target Investment Size €3m - €15m • London-based iwoca provides short-term financing to SMEs. Launched in 2012, Europe (>70%) iwoca has already grown into one of Europe's leading fintech lenders. Target Geographies RoW, particularly North America (up to 30%) • Mambuoffers an agile, flexible and affordable cloud banking platform that enables Consumer Internet & B2B, E-Commerce, innovative banking providers to rapidly create, launch and service loan and deposit Target Sectors E-Services, Marketplaces, SaaS products. Based in Berlin. Investment Style Active (seeking board membership) Full Portfolio • actoncapital.com/#Portfolio Deal Structures Qualified minority stakes KEY CONTACTS Key Investment Criteria B2C or B2B-SaaS focus, cash-generative, growth stage, selectively early (no seed) Website www.actoncapital.com Marcus Polke Christoph Braun Fritz Oidtmann Frank Seehaus Aline Vedder Contact Email [email protected] Investment Managing Managing Managing Director Director Partner Partner Partner Communications Contact Phone +49 89 2421 8870 [email protected] [email protected] [email protected] [email protected] [email protected]

Astutia KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Munich, Berlin ASTUTIA is an independent investment company focusing on innovative founders and companies with outstanding growth potential. The firm invests in the areas of E-Commerce, Digital Media and Enterprise Solutions, usually from early start-up to growth stages. Besides venture capital, they offer a truly international Founded 2006 network and specialised know-how for entrepreneurs to support successful development and sustainable growth. Their latest exits include Flaconi, Amorelie and Dreamlines. Employees 8 (of which 8 in Europe) Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Berlin-based 99 Chairs offers online-based professional interior design and a wide choice of high quality furniture to suit every pocket. Target Investment Size €100k – €1m • BettenRiese offers a wide variety of mattresses and accessories along with services like a virtual consultant tool and 100 days feel-good warranty. Target Geographies Germany, Europe • With personalized search, integrated price comparison and direct purchase option, Target Sectors E-Commerce,Digital Media, Enterprise Stylelounge makes shopping your favorite pieces even more convenient. Solutions Investment Style Passive Full Portfolio • www.astutia.de Deal Structures Minority stakes KEY CONTACTS • Benedict Rodenstock • Worked formerly for Hubert Burda Media, WEB.DE Key Investment Criteria Team,Market • Partner and Roland Berger Strategy Consultants; MBA, • Email: [email protected] studied in Bologna, St.Gallen and New York • Companies: 99Chairs, BettenRiese, Coureon Website www.astutia.de • Bernd Schruefer • Formerly co-founder of asset management company, Contact Email [email protected] • Partner founder of single family office, investment banker at • Email: [email protected] Unicredit Group, studied business administration Contact Phone +49 89 18908388 - 0 • Companies: Dreamlines, Flaconi, Stylelounge

Atlantic Labs KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin Atlantic Labs (previously Atlantic Internet/Atlantic Ventures) is a Berlin based early stage investor. They focus on disruptive digital technologies/business models and fostering passionate entrepreneurs. Founded 2007 Employees 6 (of which 6 in Europe) Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Leading social sound platform where anyone can create sounds and share them everywhere Target Investment Size N/A • Klara enables secure communication between patients and dermatologists before, during and after treatment, allowing patients to be diagnosed quickly and securely Target Geographies Europe • Multi-mode search tool that compares and combines rail, air, bus, and car for Target Sectors Tech-driven sectors European destinations Investment Style Active Full Portfolio • www.atlanticlabs.de/ Deal Structures Minority KEY CONTACTS • Christophe Maire • Christophe has more than 18 years’ experience as a Key Investment Criteria Tech-driven business • Founder & CEO founder and CEO of technology ventures. He founded gate5 (acquired by Nokia) and he was angel investor of Readmill, Plista, StudiVZ, and Brands4Friends Website www.atlanticlabs.de • Companies: EyeEm, Soundcloud • Dario Galbiati Alborghetti • Dario joined Atlantic Labs as venture partner in 2015. Contact Email N/A • Venture Partner He founded Views and Palo Jerky • Previously: international partnership at Deutsche Contact Phone N/A Telekom

Balderton Capital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Balderton Capital’s focus is on early stage, European technology businesses, with ambitious founders and unique approaches. Balderton is the largest Europe focused early stage venture fund, with funds totalling $2.3bn. Balderton invests Founded 2000 between $1m to $20m into companies with the potential to disrupt huge industries, and the ambition to scale globally. Balderton invests for the long term, with the ability to support our companies from start to exit. Employees 30 (of which 30 in Europe) What makes them different is the equal partnership, including two founders of $bn companies and former execs from Uber, Dropbox, Google and Yahoo. Current Fund Size $305m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $2.3bn • Leading mobile casual games developer, based in Berlin Target Investment Size $1m - $20m • The future of music publishing, ensuring their artists (representing ~40% of the top 100) are paid rapidly and fairly across all offline & online platforms Target Geographies Europe • World-leading online retailer, with proprietary tech stack, focussed on health & beauty Target Sectors Tech and active across Europe and the US Investment Style Active Full Portfolio • www.balderton.com Deal Structures Minority KEY CONTACTS • Rob Moffat • Partner at Balderton since 2009 Key Investment Criteria Team, disruptive • Partner • Previously at Google • Email: [email protected] • Companies: Wooga, Carwow, Prodigy Finance, Website www.balderton.com Nutmeg, Rentify, Patients Know Best Contact Email [email protected] Contact Phone +44207016 6800

Bauer Venture Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Hamburg, Stockholm Bauer Venture Partners focus on digital media (Owned Content, Aggregators, Functional Apps, Classifieds) and publishing technologies (Content Creation, Distribution & Monetization), early and later stages and the German and Nordic regions. Founded 2014 Bauer Venture Partners are financial, profit-oriented investors. But, if it provides value, they could offer the advantages of a strategic investor, in particular access to the assets and infrastructure of one of the leading international media companies with a strong footprint in markets like Germany, UK, Poland, USA, Australia, Employees 7 (of which 7 in Europe) Nordics and more. Current Fund Size €100m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Global leading meta-search and recommendation engine for food and recipies. California-based. Target Investment Size €1m - €7m • A leading calory and fitness tracking app. Featured by Apple. Stockholm-based. Target Geographies Germany, Austria, Switzerland, Nordics • Global category leader in plus-size premium fashion for women. London- and Target Sectors Digital Media and Publishing Tech Aachen- based. Investment Style Active, hands-on Full Portfolio • www.bauerventurepartners.vc/ Deal Structures Flexible KEY CONTACTS • Iskender Dirik • Managing Directo at BVP Key Investment Criteria Top-notch team, scaling by technology • Managing Director • Previously: M&A for Bauer Media Group, Founder of • Email: [email protected] several Product-Startups, MD at Technology & Digital Media Consulting Boutique, Management Consulting Website www.bauerventurepartners.vc • Companies: Navabi, Contorion • Lise Rechsteiner • Investment manager at BVP Contact Email [email protected] • Investment Manager • Previously: MD at Helpling.se, PhD at ETH Zurich • Email: [email protected] • Companies: CareerFoundry Contact Phone +49 40 3019 1078

Beringea KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Michigan (USA) Founded in 1988, Beringea is an investor in high growth businesses, with over £450m under management and 60 portfolio companies. Based in London and Michigan, U.S., Beringea invests between £1m - £20m into businesses looking for a supportive growth partner. Founded 1988 With over £170m managed in London, and over 40 UK portfolio businesses, Beringea manages one of the UK’s biggest evergreen growth capital funds. The team of experienced investors has a great track record of identifying Employees 32 (of which 22 in Europe) winning companies and outstanding management teams across a range of sectors including software, digital mediaand e-commerce. Current Fund Size £467m (£176m in UK) Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM £467m (£176m in UK) • Blis is an advertising technology company that uses location and demographic data to identify and target bespoke customer audiences. Target Investment Size £1m - £20m • Watchfinder is a specialist pre-owned luxury watch retailer. The Company allows consumers to purchase timepieces from brands including Rolex, Omega and Cartier. Target Geographies UK and USA • Third Bridge is a primary research partner that connects investors and businesses to All (Focus –Software, Digital Media, critical intelligence. The Company provides PE firms, hedge funds and consultants Target Sectors E-commerce) with the information they need to understand the value of their business opportunities. Investment Style Active Full Portfolio • www.beringea.co.uk/portfolio/ Deal Structures Minority Growth Capital KEY CONTACTS • Stuart Veale • Stuart heads a team of Partners and staff in the UK Key Investment Criteria Minimum £1m annual revenue • Managing Partner office and sits on the investment committees of all the • Email: [email protected] firm’s UK funds. Stuart has over 25 years’ experience working within the venture capital industry. Website www.beringea.co.uk • Companies: Third Bridge; ResponseTap • Karen McCormick • Karen is a Partner and Chief Investment Officer at Contact Email [email protected] • Chief Investment Officer Beringea, she was previously with the Boston • Email: [email protected] Consulting Group and ran the watches division of Swiss Army/Wenger. Contact Phone +44 (0) 207 845 7834 • Companies: Blis; Watchfinder; Thread

Blumberg Capital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices San Francisco, New York, Tel Aviv Blumberg Capital is an early-stage venture capital firm that partners with passionate entrepreneurs to innovate and build successful technology companies. Founded 2007 Blumberg Capital specializes in leading Seed and Series A rounds collaborating with angel investors, other venture capital firms and strategic partners. They are active investors and board members – operating as an extension of the entrepreneurs’ network. Blumberg Capital invests in the best teams, solving the biggest Employees 13 (of which 4 in Europe) problems in technology hot spots around the world. The typical initial investments range from $500,000 to $5 million with additional amounts reserved for follow-on funding. Current Fund Size $200m Theheadquarter is based in San Francisco with team members in Tel Aviv and New York Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM $700m • Social reviews for e-commerce websites Target Investment Size $500k - $5m • Next generation compute and storage infrastructure Target Geographies Israel, Canada, Europe • Social media management system for businesses and organizations Target Sectors Cyber security, fintech, enterprise software, • Omni-channel payments engine marketing tech Investment Style Active Full Portfolio • blumbergcapital.com/companies/ Deal Structures Equity, minority KEY CONTACTS • Alon Lifshita • Alon is a managing director of Blumberg Capital and Key Investment Criteria Team, technology • Managing Partner head of the firm’s Tel Aviv office. Alon has been • Email: active in the Israeli, European and Japanese [email protected] technology markets for the past 20 years and has a Website www.blumbergcapital.com strong track record of sourcing and investing in exciting hyper-growth companies. Alon is a skilled business development executive, forming highly Contact Email [email protected] accretive strategic alliances with mobile operators, equipment vendors and system integrators across the globe. Contact Phone 972-52-680-2086

b-to-v Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices St.Gallen, Berlin Founded in 2000, b-to-v Partners is a venture capital fund as well as the leading network of investing entrepreneurs in Europe. The firm combines the industry expertise and experience of its members with the venture capital expertise of its investment team. With investment teams in Internet & Mobile as well as in Founded 2000 Advanced Technologies, b-to-v invests EUR 25m per year in high growth companies. In 2015, Florian Schweitzer and Jochen Gutbrod of RI Digital/Raffay & Cie. joined forces to set up a new fund. Employees 5 (Investment Team, Internet & Mobile) The firm recently invested in Primary Door (home selling service), Joblift (metasearch engine for jobs), Comtravo (travel assistant for SME), BUX (casual trading app), SevenSenders (optimized cross-border shipments for eCommerce),and Compeon (comparisonof banking products for SME). Current Fund Size €75m Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Leading online marketplace for European term deposits Target Investment Size €500k - €2.5m initially • Comparison of consumer credit offerings from more than 60 banks (Seed, Series A, Series B) Target Geographies 80% DACH, 20% globally • No. 1 marketplace for home and living across its 10 markets Target Sectors Consumer oriented business models and • 24/7 limousine service available online and as a mobile app marketplaces (they avoid gaming) • No. 1 worldwide online auction house Investment Style N/A Deal Structures N/A KEY CONTACTS Disrupting an existing industry, unique market • Florian Schweitzer Key Investment Criteria positioning, defendable assets • General Partner • Email: [email protected] Website www.b-to-v.com • Dr. Jochen Gutbrod Contact Email N/A • General Partner & Executive Chairman • Email: [email protected] Contact Phone N/A

Capnamic Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Cologne, Berlin Capnamic Ventures is one of Europe’s leading early-stage Venture Capital firms, with offices in Berlin and Cologne. The VC invests most of its funds in tech-startups in the German-speaking region. Beyond that, Capnamic joins forces with international co-investors. All portfolio companies are supported through Capnamic’s Founded 2012 global network of established industry partners. The venture capital firm combines expertise drawn from more than 70 investments, 13 IPOs and a strong Employees 8 (of which 8 in Europe) entrepreneurial track record in the team. The general partners are Jörg Binnenbrücker (@bibrue), Olaf Jacobi (@olafjacobi) and Christian Siegele. Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Mobile tracking and analytics solution provider Target Investment Size €500k – €3m • Enterprise Architecture Management Target Geographies Germany, Europe B2B Services, Digital Transformation, Digital • Online platform for luxury watches Target Sectors Infrastructure Investment Style Active Full Portfolio Deal Structures Minority KEY CONTACTS • Jörg Binnenbrücker Key Investment Criteria Digital Business Model, Team, Growth • Managing Partner • Email: [email protected] Website Capnamic.de • Olaf Jacobi • Managing Partner Contact Email [email protected] • Email: [email protected] • Johannes Rohde Contact Phone +49-221-67781930 • Principal • Email: [email protected]

Cherry Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin Cherry Ventures is a Berlin based, European focused early stage tech investor that was founded and is managed by three entrepreneurs that have co-founded, managed and exited some of Europe’s most successful internet companies, such as Zalando and CityDeal/Groupon. Founded 2012 They generate value through three levers: 1) Strong entrepreneurial background of the entire team Employees 10 (of which 10 in Europe) 2) LP-network of some of Europe’s most successful investors and entrepreneurs 3) Fast, structured and data-driven decision process Current Fund Size €150m+ Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Platform for consumers to sell their cars C2B • One of the fastest growing internet companies in Europe Target Investment Size Initial invest of €300k to €1.5m in seed & pre- series A, up to €10m in follow-on rounds • Germany’s leading long-distance bus provider • Market share of >70% and 10m+ passengers in 2014 Target Geographies Europe • Online marketplace to compare and book multi-day group tours worldwide Target Sectors Consumer internet, SaaS, (sales-driven) • 14,000+ tours online bookable marketplace, retail & brand building Investment Style Active Full Portfolio • www.cherry.vc/portfolio Deal structures N/A KEY CONTACTS • Daniel P. Glasner • Co-founded City Deal in Europe and sold it to Key Investment Criteria Founding team, level of ambition, scalability, • Email: [email protected] Groupon after 6 months in 2010. Co-founded Quandoo in 2012 with international growth strategy and sold it in 2015 for € 200m Website cherry.vc • Companies: Groupon, CityDeal, Quandoo, McKinsey • Filip Dames • Helped grow Zalando to € 2bn revenues and IPO in Contact Email [email protected] • Email: [email protected] 2014. Led teams of +500 employees and managed international expansion to 15 European countries Contact Phone N/A • Companies: Zalando, Zalando Lounge, Joda Media

CommerzVentures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Frankfurt CommerzVentures is the corporate VC arm of Commerzbank and invests in FinTech and InsurTech companies across Western Europe, Israel and the US. The partners aspire to work with the best entrepreneurs who can articulate why they can dominate a given market segment. The team has >30 years of experience in venture Founded 2014 capital. CommerzVentures invests in A-C round with a focus on B rounds. Employees 6 (of which 6 in Europe) Current Fund Size €100m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €30m • Short-term loan provider to small businesses Target Investment Size €2m – €10m • Open API issuer processor platform Target Geographies Europe, Israel, and the US • Cloud banking technology platform provider Target Sectors FinTech & Insurance Investment Style Passive Full Portfolio • www.commerzventures.com/Portfolio.html Deal Structures Minority KEY CONTACTS • Patrick Meisberger • Stefan Tirtey Key Investment Criteria Team, market potential, • Managing Director • Managing Director execution, defendable USP Website www.commerzventures.com • Heiko Schwender • Paul Morgenthaler Contact Email [email protected] • Senior Investment Manager • Senior Investment Manager Contact Phone N/A

Coparion - Accelerating Momentum KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin, Cologne They are a pragmatic investor with an eye for the essentials and persistence for the long-run. Coparion helps young technology companies achieve swift and sustained growth. With assets under management of €225m they have the means to do so. They support entrepreneurial vision with their know-how, Founded 2016 but without intervening in daily business operations. Thanks to 25+ years of team experience in venture capital and in building companies, they discern potentials and open up new perspectives. They have the substance, tenacity and creativity required to mutually manage difficult situations successfully. They only invest with other Employees 9 (of which 9 in Europe) co-investors. Their focus is on the start-up and early growth phase. They appreciate initial successes, such as the sales and Current Fund Size €225m key accounts developed or successful product launches. Per company they invest up to €10m, usually in several financing rounds of €500k - €3m each. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €225m New fund, launched operations in March 2016 Target Investment Size €500k – €3m per funding round Target Geographies Germany Target Sectors IT, Internet, High-Tech, Life Science Investment Style Active Deal Structures Minority stake, with co-investors KEY CONTACTS • Christian Stein • Creathor Venture Key Investment Criteria „Traction“ (no seed funding) • Managing Director • Boston Consulting Group • Email: [email protected] • IBM Website www.coparion.de • Zadego/Easybooking • David Zimmer • Quadriga Capital Contact Email [email protected] • Managing Director • Waterland Private Equity • Email: [email protected] • Altira Contact Phone +4930 5858 4400 • T-Mobile International

Creandum KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Stockholm, Palo Alto Creandum is a leading early-stage venture capital firm investing in innovative and fast-growing technology companies. The Creandum Advisory team is based in Stockholm and Palo Alto. The Creandum funds have invested in over 50 companies including being first institutional investor in companies such as Spotify, Vivino, Founded 2003 Cint, Edgeware, IPtronics, iZettle, Videoplaza, Xeneta and many more. Employees 14 Current Fund Size €535m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €535m • Leading mobile payments company, offers small businesses portable point of sale solutions and free sales overview tools Target Investment Size €0 - €10m per round • Commercial music streaming service that provides digital content from a range of record labels and artists Target Geographies Europe and North America • App for iOS and Android that allows users to take photos of wine labels and, using image recognition technology, matches them against a database of more than 3 Target Sectors Consumer, Software, Hardware million wines and gives the reviews Investment Style Actve Full Portfolio • www.creandum.com/investment/ Deal Structures Minority KEY CONTACTS • Johan Brenner Key Investment Criteria Possibility to scale globally • General Partner • Email: Website www.creandum.com [email protected] Contact Email N/A Contact Phone N/A

Deutsche Börse DB1 Ventures NOAH Partner KEY COKEY CORPORPORARATE TE FAFACTS CTS / / KPIsKPIs INVESTOR DESCRIPTION Offices Global (Frankfurt HQ) DB1Ventures’ is the Corporate Venture Capital arm for Deutsche Börse Group (DBG). DB1 Ventures aims to be a strategic partner of choice for early to growth stage companies (bias towards Series A and above rounds), which are core or adjacent to DBG’s strategy, generate attractive investment returns and add strategic value to Founded 2016 our growth plans. The Group Venture Portfolio Management team manages DB1 Ventures and the DB1 Ventures Investment Employees 5 (DB1 Ventures) Committee,which is chaired by the DBG CEO. Current Fund Size Deutsche Börse Group Balance Sheet Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Privately held company operating the Medusa FX Option trading platform Target Investment Size €2m – €25m • VC firm focused on financial technology Target Geographies Europe, US (Asia opportunistic) Capital Markets, Data, Analytics, Alternative • Operator of stock and options markets in the U.S. and Europe Target Sectors Funding Platforms, Investment Technology Investment Style Active Full Portfolio • www.deutsche-boerse.com/db1ventures Deal Structures Minority / Control KEY CONTACTS • Ankur Kamalia • Head of Venture Portfolio Management at DBG. Key Investment Criteria Growth stage bias, strategic investments • Managing Director Previously Managing Director at UBS, and Portfolio • Email: ankur.kamalia@deutsche- Manager at Polygon Investment Partners. boerse.com • MBA-University of North Carolina at Chapel Hill. Website www.deutsche-boerse.com/db1ventures • Victor Hugo Gomez • Previously Innovation management for DBG’s Data Contact Email [email protected] • Senior Vice President business, CEO and co-founder of Funding4Learning, • Email: Investment Consultant at Mercer Consulting. victor.hugo.gomez.zerpa@deutsche- • MBA - WHU School of Management. Contact Phone +496921116699 boerse.com

Deutsche Telekom Strategic Investments KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Bonn, Palo Alto Deutsche Telekom Strategic Investments (DTSI) is Deutsche Telekom’s strategic investment group. Founded in 1997, with a cumulative budget volume of over $800m, DTSI is one of the largest corporate venture funds in the technology industry. The group has made over 200 investments and manages a current portfolio of Founded 1997 around 90 companies, including several "unicorns". DTSI supports and encourages breakthrough innovation that produces new and exciting services and solutions for Deutsche Telekom’s 200 million mobile, fixed-network, and broadband customers. Employees 21 (of which 19 in Europe) Current Fund Size from balance sheet Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • NGENAprovides business with physical and virtual networks through hybrid VPN and its innovative cloud technology Target Investment Size €5m - €100m • I-am-plus produces Dial, a voice-enabled smarcuff designed by i.am+, the tech company founded by musician and entrepreneur will.i.am Target Geographies Europe, Israel, USA • Kumu Networks was founded by a team of Stanford Universiry Professors and Ph.D graduates to commercialize research on Wireless Full Duplex, an innovative wireless Target Sectors Technology transceiver design Investment Style Active Full Portfolio • www.telekom.com/dtsi Deal Structures Control, joint control, minority KEY CONTACTS • Thomas Grota • https://de.linkedin.com/in/thomasgrota Key Investment Criteria Strategic fit, innovative impact • Investment Director • Companies: ngena; flaregames, NumberFour, ‚ • Email: [email protected] Gini GmbH (Exits: myTaxi, Wunderlist, Swoodoo, apprupt) Website www.telekom.com/dtsi • Randeep Wilkhu • https://www.linkedin.com/in/rwilkhu Contact Email [email protected] • Investment Director • Companies: i-am-plus, immmr, smarkets, Boku, • Email: [email protected] Contact Phone N/A

DN Capital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Menlo Park, Berlin DN Capital is a global early stage and growth capital investor in software, mobile applications, digital media, marketplace and e-commerce companies. The firm has operations in London, Berlin and Menlo Park and its objectives is to identify, invest in and actively support its portfolio companies to become global leaders. Founded 2000 Portfolio companies include Shazam (the world’s leading mobile app), Auto 1 (world’s largest online used car marketplace valued at over €1bn), Endeca (sold to Oracle for over $1bn), Apsmart (sold to Thomson Reuters), Employees 30 (of which 22 in Europe) Datanomic (sold to Oracle), Quandoo (acquired by Recruit Holdings), Mister Spex, OLX (sold to Naspers), Performance Horizon Group, Purplebricks (IPO London) and windeln.de(IPO Frankfurt). The professionals at DN Capital bring over 60 years of private equity experience to their investments, and Current Fund Size €144m actively work with portfolio companies to steward their growth through the various stages of development. Additional information about the firm and its portfolio companies can be found at www.dncapital.com Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/a • #1 music and media recognition on mobile devices. • Valued at $1bn+ Target Investment Size €250k - €20m • Leading search and business intelligence software company. 75% Europe (UK, Germany, France, Nordics) • Acquired by Oracle in 2011 for $1.1bn Target Geographies 25% US & ROW • Leading baby and toddler e-commerce platform in DACH 1) E-commerce;2) Marketplaces; • IPO in May 2015 Target Sectors 3) Digital Media; • C2B seller of used cars to dealerships using online to acquire inventory 4) Enterprise software & Fin Tech; 5) Mobile • One of Europe’s fastest growing unicorns Investment Style Active • Valued at over €1bn Deal Structures N/A KEY CONTACTS • Nenad Marovac • Partner at Advent International, MBA Harvard Key Investment Criteria Team,Market, Product, Traction and Deal • Managing Partner and CEO Business School. Focus on consumer internet, • Email: [email protected] marketplaces, ecommerce, mobile applications • Companies: Auto1, Book a Tiger, Datanomic, Happn, Website www.dncapital.com HomeToGo, Tbricks, Mister Spex, OLX, Purplebricks, Quandoo, Shazam, Windeln Contact Email [email protected] • Thomas Rubens • Barclays M&A, University of Bristol. Focus on • Principal ecommerce, Marketplaces, Software Contact Phone 02073401600 • Email: • Companies: Auto1, Book a Tiger, Caroobi, [email protected] HomeToGo, Quandoo, Optilyz, ShipHawk

Earlybird Digital West and East KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin, Munich, Istanbul Early Stage Venture, Investments in disruptive digital businesses in Europe. Founded 1997 Employees 35 (of which 35 in Europe) Current Fund Size €150m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €750m • Vertically integrated platform for moving services Target Investment Size €500k – €15m • Banking product for smartphones Target Geographies Europe Target Sectors Consumer and enterprise internet, fin-tech, • Enterprise-ready, open core, in memory computing software marketplaces, SaaS Investment Style Active Full Portfolio • www.earlybird.com Deal Structures Minority KEY CONTACTS Disruptive business models or technologies • Cem Sertoglu • Prior Founder & CEO Select Minds Key Investment Criteria with forward looking lock-in in large markets • Partner • Focusing on technology ventures in Turkey and CEE lead by an outstanding team • Email: [email protected] • Companies: dcs+, flipps, hazelcast, peak games, Website www.earlybird.com tapu.com, dolap.com, apsiyon Contact Email [email protected] Contact Phone +49 30 46724700

Eight Roads KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Hong Kong, Beijing, Shanghai, Eight Roads is one of the largest venture and growth investors globally, with offices across three continents and Tokyo, Mumbai a near 50 year history of investing. A strong track record includes investments in Notonthehighstreet, Appsflyer, Wahanda (exited), Innogames (exited), Curam Software (exited), Made.com, Neo4j and More2. The Europe Founded 1998 team focus primarily on scale-up investments in the €5m – €25m range and work closely with their colleagues across the globe. Employees 52 (of which 9 in Europe) Current Fund Size $250m in Europe Use of Debt No SELECTED PORTFOLIO COMPANIES AUM Undisclosed • Made is an online furniture retailer headquartered in London Target Investment Size $5- $25m • Appsflyer is a mobile advertising attribution and analysis platform. Headquartered in Tel Aviv Target Geographies Europe & Israel • Neo is a NoSQL graph database. Originally founded in Malmo, the company is Target Sectors Consumer, Enterprise, Fintech/Finserv currently headquartered in San Francisco Investment Style Active Full Portfolio • eightroads.com/en/ventures/europe Deal Structures Flexible KEY CONTACTS Fast growing entrepreneurs with global • Michael Treskow • Michael joined Eight Roads from Accel London in Key Investment Criteria ambitions • Partner 2016. Previously he worked for Warburg Pincus in • Email: San Francisco [email protected] • Companies: GoCardless, World Remit, Packlink, Website www.eightroads.com/en Funding Circle (from Accel) • Asheque Shams • Asheque joined Eight Roads in 2014. Previously he Contact Email [email protected] • Associate worked in tech investment banking • Email: • Companies: Universal Avenue Contact Phone +44 (0)20 7074 5613 [email protected]

eValue Group KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin The 2nd eValue Fund invests in early stage opportunities in the European digital media market. eValue sees great potential in this sector, great performing tech companies and the capacity to be an enormous growth market. Founded N/A eValue invests in digital media companies with a strong focus on technology. The firm believe that technology movesanddevelops the internet and shifts the digital boundaries we are experiencing today. Europe provides a huge diversity and whole lot of great ideas, in technology, in advertising and other internet Employees 9 connected business ideas. eValue focuses on this often underserved market and give companies in all European countries, including eastern Europe and Russia a helping hand to grow in their home countries and internationally. Current Fund Size N/A eValue supports companies in A and B rounds of their investment strategies as well as, if we are carried away by a profound and disruptive business idea with seed stage investments. Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Tealium is the leader in enterprise tag management and helps organizations increase marketing agility, reduce tagging costs, and improve site performance Target Investment Size €500k - €3m • The Trade Desk is an online demand-side platform that provides buying tools for Target Geographies Europe digital media buyers. Online Marketing and Advertising, Content / • Meetrics provides cutting edge solutions to manage online marketing across all Target Sectors Video, Gaming, Ad Technology, Performance channels Marketing, Cloud Services Full Portfolio • www.evalue.de/ Investment Style Active KEY CONTACTS Deal Structures Minority • Thomas Falk • Fascinated by the opportunities, which technology Key Investment Criteria Geography and sectors • CEO paired with the internet offer, Thomas Falk founded his first company while still in school. Now he counts as one of Europe’s most successful entrepreneurs Website www.evalue.de/ and has a deep executive experience along the whole digital value chain. Mr. Falk can rely on an extensive network in the internet technology industry spanning Contact Email N/A all of Europe and the US. Contact Phone N/A

FJ Labs KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices New York Founded in 2015, FJ Labs is a New York-based investment firm focused on seed- and early-stage investments. Founded 2015 Employees 16 Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Peer to Peer car marketplace Target Investment Size $50k - $5m • Mobile wholesale ecommerce Target Geographies USA, Germany, UK, France, Spain, Brazil, Russia, India Marketplace; ecommerce; travel; utility • End-to-End freight forwarding marketplace Target Sectors software; gaming; data analytics Full Portfolio • www.fjlabs.com/portfolio Investment Style Active Deal Structures N/A KEY CONTACTS • Fabrice Grinda • Fabrice Grinda is an Internet entrepreneur, angel Key Investment Criteria N/A • Managing Partner & Co-Founder investor, student and lover of life, aspiring Renaissance man and co-founder of OLX, one of the largest free classifieds sites in the world. He is an Website fjlabs.com investor in over 200 startups including Uber, Airbnb, Beepi, Betterment and Palantir. He is an avid skier, tennis player and kite surfer. Contact Email N/A Contact Phone N/A

Frog Capital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Frog Capital is a leading growth capital investor focused on technology-led businesses in Europe. Frog’s experienced team has invested in over 100 companies, and in the last six years has exited companies Founded 2008 with a total transaction value over €1 billion. Frog is a committed long-term partner, investing in ambitious companies with revenue up to €30m and requiring Employees 8 (of which 8 in Europe) up to €20m of growth capital. By applying industry knowledge, a network of relationships and operating expertise, Frog actively supports Current Fund Size €90m exceptional company growth and builds significant shareholder value. For further information, please visit www.frogcapital.com. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €180m • Germany’s No. 1 online real estate agent Target Investment Size €2m - €10m • Leading European online money transfer service provider Target Geographies Europe Target Sectors IT, Digital Media & Resource Efficiency Investment Style Active Deal Structures Minority of majority KEY CONTACTS • Iyad Omari • Jens Düing Key Investment Criteria Generating €3m-€30m of revenue • Partner • Principal Website www.frogcapital.com • Mike Reid • Joe Krancki Contact Email [email protected] • Managing Partner • Partner Contact Phone +44 (0)20 7833 0555

German Startups Group Berlin KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 2 German Startups Group is an investment company based in Berlin that focuses on young, fast-growing companies, so-called startups. The company acquires majority and minority shareholdings mainly by providing venture capital. Its focus is on companies whose products or business models represent a disruptive innovation, Founded 2012 allow for a high degree of scalability to be expected, and in which it has a great deal of trust in the entrepreneurial abilities of the founders. Since it commenced with operations in 2012, German Startups Group has in its opinion built up a diversified portfolio of investments in young companies and become the second most Employees 18 (of which 18 in Europe) active venture capital investor in Germany since 2012 (CB Insights, Germany Venture Capital Overview). According to German Startups Group, its investment portfolio reflects a cross-section of extremely promising German startups of various maturity stages and includes some of the most successful and best-known German Current Fund Size N/A startups. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • SoundCloud Target Investment Size €100k – €3m • Delivery Hero Target Geographies German-speaking region E-commerce, software, mobile, FinTech, • Mister Spex Target Sectors German Engineering Investment Style Active Full Portfolio • www.german-startups.com/about-us/#holdings Deal Structures Control, joint control, minority KEY CONTACTS Entrepreneurial talent, scalability, disruptive • Christoph Gerlinger • Founder and former CEO of Frogster Interactive Key Investment Criteria potential • CEO Pictures AG, which he took public. Former Head of German operations Infogrames/Atari. Former CFO of CDV Software Entertainment. Website www.german-startups.com/about-us/ • External expert for CDU on “Digitalisation” • Nikolas Samios • Founder and CEO of Cooperativa Venture Services Contact Email [email protected] • Chief Investment Officer • Former CEO of Brandenburg Ventures Contact Phone +49.30.6098890.80

Grazia Equity KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 2 Grazia Equity, based in Stuttgart and Munich, is one of Europe’s top names in venture capital. Grazia specializes in start-up or early-stage financing for innovative companies with market-changing potential and opportunities for superior returns. Our successful track record and expanding global network now enable us to fund selected start- Founded 2000 ups elsewhere in Europe as well as in the US. Unlike traditional venture capital companies, Grazia works exclusively with private-sector capital, with no institutional funding involved. That gives our portfolio companies all the advantages of speed, flexibility and a Employees 5 (of which 5 in Europe) pragmatic approach. This may sound more typical of a business angel but, at Grazia, we back up agility with the solid funding and business development expertise you would normally expect of a VC firm. This combination, paired with our uncompromising ethical standards and commitment to sustainability, makes Grazia the ideal Current Fund Size N/A choice for businesses early in their life cycle. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • E-commerce enterprise specialized in the sale of glasses, sunglasses and contacts Target Investment Size €0 - €500k • Fastest growing movie community in the world with large properties on facebook, youtube, and 2 of the leading movie sites: moviepilot.de and moviepilot.com Target Geographies Germany, USA, GB • The first statistics portal in the world to integrate over 60,000 diverse topics of data Target Sectors Internet, Digital Media, Mobile, and facts from over 10,000 sources onto a single professional platform Telecommunication Investment Style Board seats if possible, networking on Full Portfolio • www.grazia.com/en/portfolio.html demand Deal Structures N/A KEY CONTACTS • Alec Rauschenbusch Key Investment Criteria Attractive market potential + scalability, • CEO significant added value • Email: [email protected] Website www.grazia.com • Jochen Klueppel Contact Email [email protected] • Partner • Email: [email protected] Contact Phone +49 711 90 710 90

GV KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Mountain View, San Francisco, New York Launched as Google Ventures in 2009, GV is the venture capital arm of Alphabet, Inc. They have invested in City, Cambridge, London more than 300 companies that push the edge of what’s possible. In the fields of life science, healthcare, artificial intelligence, robotics, transportation, cyber security, and agriculture, their companies aim to improve lives and Founded 2009 change industries. They have built a team of world-class engineers, designers, physicians, scientists, marketers, and investors who Employees 82 work together to provide these startups exceptional support on the road to success. They help their companies interface with Google, providing unique access to the world’s best technology and talent. Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Mobile app connecting passengers with drivers for hire Target Investment Size N/A • Tamr, Inc., catalogs, connects and publishes the underutilized internal and external data using a combination of machine learning with human guidance so enterprises Target Geographies Global can use all their data for analytics • Team communication application providing services such as real-time messaging, Target Sectors Consumer, life science and health, data and archiving, and search for modern teams AI, enterprise, robotics Investment Style Active Full Portfolio • www.gv.com/portfolio/ Deal Structures Minority KEY CONTACTS • Avid Larizadeh Duggan • Previously: co-founded at Boticca (acquired by Wolf & Key Investment Criteria N/A • General Partner Badger in 2015), investor team at Accel Partners, Tellme Networks, eBay, Skype Website gv.com Contact Email N/A Contact Phone N/A

HanseVentures BSJ KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Hamburg They are an incubator for internet ventures, combining… • start-up concepts, Founded 2010 • talented people seeking to become founders who we scout and train, • skills and resources to accelerate growth (like coding, online marketing, PR and recruitment), • seed funding from their own resources and an extensive network of co-investors Employees 30 …inorder to build great companies. Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM N/A • Crowd-based high-end B2B translation services Target Investment Size N/A • Network of voucher code sites in fast growing e-commerce markets Target Geographies Hamburg Target Sectors Internet & mobile • Market place for second hand designer fashion and accessories Investment Style Founding of 2-4 start-ups p.a. Full Portfolio • www.hanseventures.com/en/portfolio/ Deal Structures Incubator model: Straight equity, resources KEY CONTACTS and infrastructure Scalable online based concepts, talented • Alex Eulenburg • 12 years TMT investment banking in London and Key Investment Criteria people and good match with Hanse Ventures • Partner and CFO Hamburg • Email: • PhD in applied physics Website www.hanseventures.com alexander.eulenburg@hanseventure s.com Contact Email alexander.eulenburg@ hanseventures.com Contact Phone +49 40 38 66 25 95

High-Tech Gründerfonds KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Bonn High-Tech Gründerfonds (HTGF) is Germany’s most active and leading seed stage investor. We finance technology-driven companies in the fields of cleantech, robotics, drug development, chemical processes or new software. The fund is focused on investing in small companies (younger than 1 year) with a high level of Founded 2005 innovation. The company or an independent branch of it is domiciled in Germany. It must be based upon a technological innovation – significant and close to proof of concept with in-depth technological knowledge and expertise. The aim is to overcome the gap in early-stage enterprise finance and to enable the firm to obtain risk Employees 45 (of which 45 in Europe) capital. Typically, High-Tech Gründerfonds invests EUR 600,000 in the seed stage, with the potential for up to a total of EUR 2 million per portfolio company in follow-on financing. Investors in this public/private partnership include the Federal Ministry of Economics and Energy, the KfW Banking Group, as well as strategic corporate Current Fund Size €576m investors. High-Tech Gründerfonds has about EUR 576 million under management in two funds (EUR 272 million HTGFI,EUR304millionHTGFII). Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Outfittery takes the pain out of shopping for men by providing the first personal shopping service for customers, who want to be dressed well, but hate shopping Target Investment Size €600k - €2m • Ubermetrics refines and filters public information from online and offline sources to help companies optimize business decisions and performance Target Geographies Germany • VMRay’s monitoring and analysis technology utilizes advanced hardware- virtualization for the analysis of malware, such as regular viruses, worms, trojans, Target Sectors Hardware, Software, Life Science spyware, but also complex and sophisticated kernel rootkits and bootkits Investment Style Active Full Portfolio • http://high-tech-gruenderfonds.de/en/#network-events Deal Structures Minority KEY CONTACTS • Dr. Alex von Frankenberg Key Investment Criteria Seed Funding • Managing Director • Email: [email protected] Website www.htgf.de/en/ • Chiara Sommer Contact Email [email protected] • Investment Manager • Email: [email protected] Contact Phone +49 228-82300-100

Holtzbrinck Digital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Munich, London, Boston Holtzbrinck Digital invests globally in internet businesses in the areas of science, education, content and health. They support entrepreneurs with a long-term vision to build valuable companies in a global environment. Their expertise, network and background enables them to support their portfolio companies in reaching the next level Founded N/A of growth. Employees 15 Current Fund Size Evergreen Use of Debt No SELECTED PORTFOLIO COMPANIES AUM Not disclosed • Investment vehicle 100% owned by Holtzbrinck Digital that supports startups in the space of scientific research technology Target Investment Size €0.5m – €25m • The pioneer and leading global enterprise platform for search experience Target Geographies Germany, UK; US; Global optimization, which combines SEO, content, social media, PR & analysis Science, Education, Content, Health – Only • The leading German question-and-answer website and among the most popular 20 Target Sectors Internet & Software related pages in Germany Investment Style Active, Board support Full Portfolio • www.holtzbrinck-digital.com Deal Structures Minority & majority investments, KEY CONTACTS Open for syndication Segment, Team, Product/Market, Proof-of- • Markus Schunk • Joined Holtzbrinck in 2004 Key Investment Criteria concept • CEO • Vast experience in digital media M&A transactions • Email: Website www.holtzbrinck-digital.com [email protected] • Michael Hock • Holtzbrinck Digital since 2011 Contact Email [email protected] • Managing Director • 10+ years experience in VC/M&A • Email: • Heading the Education & Science Investments Contact Phone +49 89 452285100 [email protected]

HV Holtzbrinck Ventures NOAH Partner KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 2 “Weliketo invest at seed stage and quickly provide additional capital at the moment of initial success!” HV Holtzbrinck Ventures has been investing in internet companies for 16 years, primarily during their start-up phase. In this time, Holtzbrinck Ventures has financed over 150 companies, and has established itself as one of Founded 2000 the most successful venture capital firms in Europe. Past portfolio companies Groupon (IPO), Quandoo (acquired by Recruit), Stylight (acquired by Pro7), Brands4Friends (acquired by Ebay), Parship (acquired by Holtzbrinck Publishing Group), Audible (acquired by Amazon) and many more. Employees 17 Current Fund Size €285m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €635m • Europe's largest online fashion company Target Investment Size €500k - €40m • Fastest growing European long-distance bus operator Target Geographies Europe + high growth global markets Target Sectors Internet / Mobile / Digital • Fully licensed automated robo-advisor for private wealth management Investment Style Active Full Portfolio • www.holtzbrinck-ventures.com/portfolio Deal Structures Minority KEY CONTACTS Key Investment Criteria Multi stage, early-in Teams focused on execution Website www.holtzbrinck-ventures.com Lars Langusch David Kuczek Martin Weber Barbod Namini Jasper Masemann Nawid Ali-Abbassi Contact Email [email protected] General Partner General Partner General Partner Principal Principal Investment Manager Nawid.ali- Contact Phone +49 89 20607751 Lars.langusch@holt david.kuczek@holtz Martin.weber@hol Barbod.namini@ Jasper.masemann@h abbassi@holtzbrinck. zbrinck.net brinck.net tzbrinck.net holtzbrinck.net oltzbrinck.net net

iAngels KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Tel Aviv iAngels is Israel’s leading angel investment network, leveraging best-in-class due diligence to enable accredited investors around the world to gain access to the most-exclusive early-stage technology deals in the market. iAngels sources, screens and leads investment rounds, with a focus on early-stage software companies across Founded 2013 multiple verticals. In addition to managing core assets of $50m, iAngels operates a proprietary software platform, built to convene and mobilize a global community of thousands of accredited angel investors, investing alongside a close network Employees 20 of Israel's most prominent angels and VCs. In less than three years, iAngels has invested in over 60 startups, registered two exits, and built a full-service in- Current Fund Size N/A house investment team, led by founders Mor Assia (SAP Labs, IBM, Amdocs) and Shelly Hod Moyal (Goldman Sachs, Avenue Capital, UBS). Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM $50m • Unicorn is a stealth cybersecurity company using machine learning and deep learning algorithms to detect and prevent cyberattacks Target Investment Size $500k - $2m • Missbeez is a mobile on-demand platform that seamlessly connects professional Target Geographies Israel. US beauticians with consumers Fintech, Enterprise Software, Artificial • indeni is a proactive IT network management tool, enabling companies to focus on Target Sectors Intelligence, Smart Cities, Cyber Security, growth acceleration rather than network failures IOT, Impact. Full Portfolio • https://my.iangels.co/#/browse/startups Investment Style Active KEY CONTACTS Deal Structures Minority • Mor Assia • https://www.iangels.co/team/mor-assia/ Key Investment Criteria Management, Traction, Product, Technology • Founding Partner • Email: [email protected] Website www.iangels.co • Shelly Hod Moyal • https://www.iangels.co/team/shelly-hod-moyal/ Contact Email [email protected] • Founding Partner • Email: [email protected] Contact Phone +972 72-247-8089

International Finance Corporation KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 108 offices in 98 countries IFC is part of the World Bank Group and the largest global development institution focused on the private sector. IFC’s Venture Capital (VC) group invests in sustainable technology-driven ventures that make an impact in emerging markets, while also realizing strong returns. The goal is to accelerate deployment of innovation in Founded 1956 regions that need it the most. IFC VC invests both in local businesses based in emerging markets, as well as increasingly in US/European companies with business solutions geared towards emerging markets. To date, IFC has invested almost US$1 billion in ventures in Global Internet (including ecommerce), health, education and Employees 4,000 cleantech. Current Fund Size Balance sheet investor Use of Debt Flexible SELECTED PORTFOLIO COMPANIES AUM $50bn • Souq - Online retailer in the Middle East Target Investment Size $5m - $50m • Netshoes - Online platforms for sporting goods Target Geographies Global Emerging Markets • Lenskart - Online optical store Target Sectors Technology and Technology-enabled Full Portfolio • www.ifc.org/vc/portfolio Investment Style Active board members Deal Structures Flexible KEY CONTACTS • Ruzgar Barisik • Ruzgar Barisik is co-head of IFC’s Consumer Key Investment Criteria Early stage to growth equity and Fund LP • Senior Investment Officer Internet practice and leads the organizations investments • Email: [email protected] Venture Capital investments in Europe, Middle East & North Africa. IFC is the largest international Website www.ifc.org/vc development institution focused on the private sector in developing countries, and a part of the World Bank Group. Contact Email [email protected] Contact Phone +1 202 473 7400

Index Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, San Francisco, Geneva Index Ventures is an international venture capital firm that backs the best and most ambitious entrepreneurs in Europe, the US and Israel, across all company stages, from seed to venture to growth. These leaders are building truly transformative companies that are reshaping the world around us, including Adyen, BlaBlaCar, Founded 1996 Dropbox, Deliveroo, Dubsmash, King, Squarespace, Sonos, SoundCloud and Supercell – among many others. Employees 58 Current Fund Size $550m (seed and venture) $700m (growth) Use of Debt N/A SELECTED PORTFOLIO COMPANIES AUM $5.8bn • Adyen is a global omni-channel payment company Target Investment Size Up from $100k • Deliveroo delivers top quality food from premium local restaurants to homes and Target Geographies Global offices Business Services, Communications, • Dropbox is a file sharing and cloud storaging solution Target Sectors Entertainment, Fashion & Luxury, Fintech, Healthcare, Infrastructure, Marketing, Retail, Software, Travel & Leisure Full Portfolio • www.indexventures.com/companies/a-z Investment Style Active KEY CONTACTS Deal Structures N/A • TimmSchipporeit • Timmhas spent his entire career working in the Key Investment Criteria N/A • Principal European technology sector, having advised tech • Email (assistant): companies on more than $20 billion of M&A, IPO [email protected] and capital raising transactions – including Adyen, Website www.indexventures.com Alcatel-Lucent, Autotrader, First Data, SAP, Siemens, Scout24, Supercell, Worldpay, Yandex and Zalando among others. At Index, Timmfocuses Contact Email N/A on venture and growth investments in the DACH region and across Europe. Contact Phone +44 20 7154 2020 • Previously: Morgan Stanley • Companies: Collibra, MyOptique, Pets Deli

Inventure Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Moscow Inventure Partners is an innovative investment firm helping inventive entrepreneurs start and grow disruptive technology businesses. They look for teams with a novel approach to solving real problems and back a wide range of ventures across technology industry with an emphasis on internet, mobile, software and e-commerce Founded 2012 segments. Although, their sweet spot is an investment of $1m - $5m, they are generally flexible on the investment size and can back attractive business models both at the earliest stages of their development as well as at the reasonably late stages. Employees 8 (of which 8 in Europe) Current Fund Size $100m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $100m • Taxi aggregator service allowing smartphone users to book a taxi Target Investment Size $1m-$5m • Online tourist agency selling packaged tourist tours via its web-site Target Geographies Russia, CIS, Europe, US Technology, Internet, Financial Technologies, • Mobile payment solution allowing users to accept payments through mobile phones Target Sectors Marketing, Digital Media, Mobile, Telecommunication Investment Style Board and operational support on demand Full Portfolio • www.inventurepartners.com/portfolio/ Deal Structures Minority KEY CONTACTS • Sergey Azatyan • Inventure Partners since 2012 Key Investment Criteria Established business model and rapid growth • Managing Partner • Companies: Marshall Capital, MDM Bank potential • Email: Sergey.Azatyan@inventurepartners. Website www.inventurepartners.com com • Anton Inshutin • Inventure Partners since 2012 Contact Email [email protected] • Managing Partner • Companies: Morgan Stanley, Deutsche Bank • Email: [email protected] Contact Phone +7 495 641 3635 om

K FUND KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Madrid K Fund is an early stage VC firm that, with an entrepreneur-centric philosophy, aims to fuel the evolution of the Spanish startup ecosystem by investing in the best and brightest entrepreneurs and tech companies in the region. Founded 2016 Their target is Seed & Series A investments in Spanish digital companies that think global from day one. They are looking forward to co-invest with international growth investors in Series A and Series B deals. K Fund is Employees 7 (of which 7 in Europe) looking for companies building scalable business models in verticals such as SaaS, mobile and marketplaces. Their obsession is to support entrepreneurs to accelerate growth with the team of Operating Partners, in areas Current Fund Size €50m like Engineering, Marketing, Operations and Design. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €50m • B2B platform that offers a comparison tool and algorithm for sanitary products that helps dentists and vets to optimize the purchase of materials and to improve Target Investment Size €100k - €7.5m supplier’s logistics Target Geographies Spain • B2C renewable energy supplier at a fair price Target Sectors Marketplaces, SaaS, Mobile. • Push notifications app of whatever you want Investment Style Active Deal Structures Minority KEY CONTACTS Strong management teams; Scalability; • Iñaki Arrola • 8fit, Blinkfire, Carto, Chicisimo, Deporvillage, Icontainers, Ludei, Key Investment Criteria MVP and strong growth in KPIs; • General Partner Mailtrack, Monkimum, Promofarma, Startupxplore, Wazypark Global mindset • Email: iñ[email protected] • Companies: coches.com,Vitamina K Website kfund.vc • Carina Szpilka • Vitamina K, Fintonic, Monkimun, Yump, Wazypark, Womenalia • General Partner • Companies: ING Direct, Abanca, Grifols, Melia Contact Email [email protected] • Email: [email protected] • Ian Noel • Wuaki, Toprural, Softonic, Offerum, 11870, emagister, • General Partner Medicanimal, Monkimun, Holidog, Ojala. Contact Phone +34 630 850 924 • Email: [email protected] • Companies:BonsaiVenture Capital, Simbiosis Venture Capital, Citigroup Investment Banking

Kizoo Technology Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Karlsruhe Kizoo helps young start-up teams grow. We provide seed and early stage financing with a focus on SaaS, Internet & Mobile Services and Social Applications. Apart from their financial resources, they are happy to share our longtime experience in development, marketing and product management in those markets. Founded 2008 Kizoo is looking for committed entrepreneurial teams with a clear focus to build high growth products. Employees 3 Current Fund Size €30m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €11m • The market-leading app for online learning makes it easy to access languages from English to Indonesian either from home, or on the go with a smartphone or tablet. Babbel combines high-quality courses with modern technology Target Investment Size €500k • Enables any financial institution to easily deliver state-of-the-art banking through its software-as-a-service cloud solution Target Geographies Germany, Europe SaaS, Internet & Mobile Services, • E-recruiting solution that enables organisations to optimise their recruiting process Target Sectors Social Applications Investment Style Active Full Portfolio • www.kizoo.com/en/ Deal Structures Minority KEY CONTACTS • Matthias Hornberger • CFO of Kizoo. Part of the senior management team Key Investment Criteria business model, management team • CFO since the IPO of the AG in 2000. He has a long- • Email: [email protected] standing experience in the investment sector and a comprehensive knowledge of typical features of Website www.kizoo.com successful business models on the Internet. Contact Email [email protected] Contact Phone +49721 51600