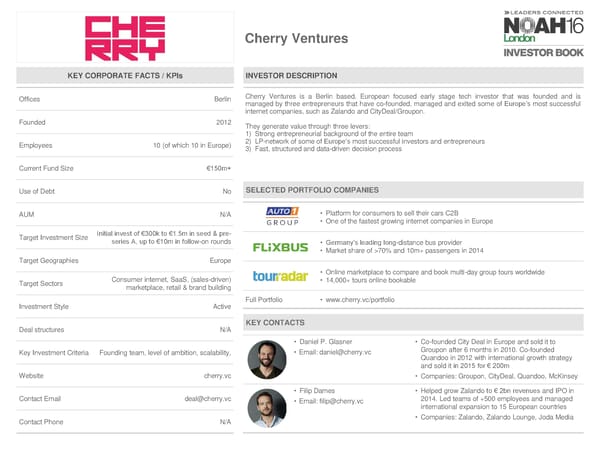

Cherry Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin Cherry Ventures is a Berlin based, European focused early stage tech investor that was founded and is managed by three entrepreneurs that have co-founded, managed and exited some of Europe’s most successful internet companies, such as Zalando and CityDeal/Groupon. Founded 2012 They generate value through three levers: 1) Strong entrepreneurial background of the entire team Employees 10 (of which 10 in Europe) 2) LP-network of some of Europe’s most successful investors and entrepreneurs 3) Fast, structured and data-driven decision process Current Fund Size €150m+ Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • Platform for consumers to sell their cars C2B • One of the fastest growing internet companies in Europe Target Investment Size Initial invest of €300k to €1.5m in seed & pre- series A, up to €10m in follow-on rounds • Germany’s leading long-distance bus provider • Market share of >70% and 10m+ passengers in 2014 Target Geographies Europe • Online marketplace to compare and book multi-day group tours worldwide Target Sectors Consumer internet, SaaS, (sales-driven) • 14,000+ tours online bookable marketplace, retail & brand building Investment Style Active Full Portfolio • www.cherry.vc/portfolio Deal structures N/A KEY CONTACTS • Daniel P. Glasner • Co-founded City Deal in Europe and sold it to Key Investment Criteria Founding team, level of ambition, scalability, • Email: [email protected] Groupon after 6 months in 2010. Co-founded Quandoo in 2012 with international growth strategy and sold it in 2015 for € 200m Website cherry.vc • Companies: Groupon, CityDeal, Quandoo, McKinsey • Filip Dames • Helped grow Zalando to € 2bn revenues and IPO in Contact Email [email protected] • Email: [email protected] 2014. Led teams of +500 employees and managed international expansion to 15 European countries Contact Phone N/A • Companies: Zalando, Zalando Lounge, Joda Media

NOAH 2016 London Investor Book Page 22 Page 24

NOAH 2016 London Investor Book Page 22 Page 24