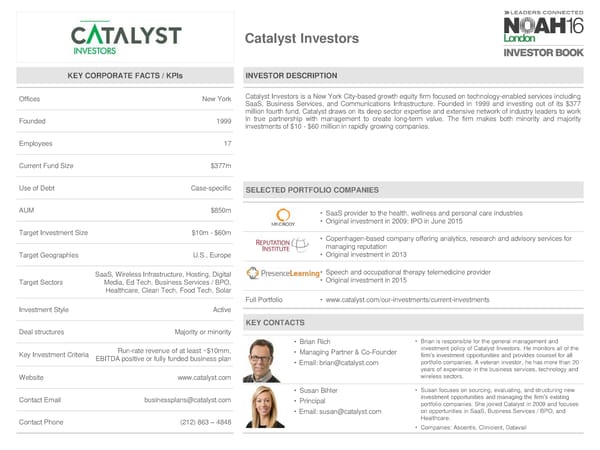

Catalyst Investors KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices New York Catalyst Investors is a New York City-based growth equity firm focused on technology-enabled services including SaaS, Business Services, and Communications Infrastructure. Founded in 1999 and investing out of its $377 million fourth fund, Catalyst draws on its deep sector expertise and extensive network of industry leaders to work Founded 1999 in true partnership with management to create long-term value. The firm makes both minority and majority investments of $10 - $60 million in rapidly growing companies. Employees 17 Current Fund Size $377m Use of Debt Case-specific SELECTED PORTFOLIO COMPANIES AUM $850m • SaaS provider to the health, wellness and personal care industries • Original investment in 2009; IPO in June 2015 Target Investment Size $10m - $60m • Copenhagen-based company offering analytics, research and advisory services for managing reputation Target Geographies U.S., Europe • Original investment in 2013 SaaS, Wireless Infrastructure, Hosting, Digital • Speech and occupational therapy telemedicine provider Target Sectors Media, Ed Tech, Business Services / BPO, • Original investment in 2015 Healthcare, Clean Tech, Food Tech, Solar Full Portfolio • www.catalyst.com/our-investments/current-investments Investment Style Active KEY CONTACTS Deal structures Majority or minority • Brian Rich • Brian is responsible for the general management and Key Investment Criteria Run-rate revenue of at least ~$10mm, • Managing Partner & Co-Founder investment policy of Catalyst Investors. He monitors all of the EBITDA positive or fully funded business plan firm’s investment opportunities and provides counsel for all • Email: brian@catalyst.com portfolio companies. A veteran investor, he has more than 20 years of experience in the business services, technology and Website www.catalyst.com wireless sectors. • Susan Bihler • Susan focuses on sourcing, evaluating, and structuring new Contact Email businessplans@catalyst.com • Principal investment opportunities and managing the firm’s existing portfolio companies. She joined Catalyst in 2009 and focuses • Email: susan@catalyst.com on opportunities in SaaS, Business Services / BPO, and Contact Phone (212) 863 – 4848 Healthcare. • Companies: Ascentis, Clinicient, Datavail

NOAH 2016 London Investor Book Page 77 Page 79

NOAH 2016 London Investor Book Page 77 Page 79