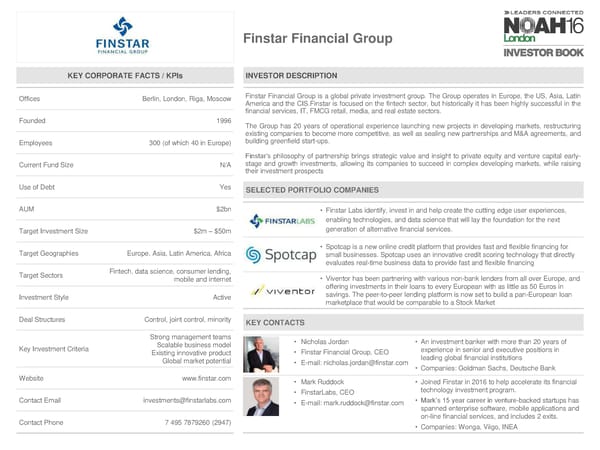

Finstar Financial Group KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin, London, Riga, Moscow Finstar Financial Group is a global private investment group. The Group operates in Europe, the US, Asia, Latin America and the CIS.Finstar is focused on the fintech sector, but historically it has been highly successful in the financial services, IT, FMCG retail, media, and real estate sectors. Founded 1996 The Group has 20 years of operational experience launching new projects in developing markets, restructuring existing companies to become more competitive, as well as sealing new partnerships and M&A agreements, and Employees 300 (of which 40 in Europe) building greenfield start-ups. Finstar’s philosophy of partnership brings strategic value and insight to private equity and venture capital early- Current Fund Size N/A stage and growth investments, allowing its companies to succeed in complex developing markets, while raising their investment prospects Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM $2bn • Finstar Labs identify, invest in and help create the cutting edge user experiences, enabling technologies, and data science that will lay the foundation for the next Target Investment Size $2m – $50m generation of alternative financial services. Target Geographies Europe, Asia, Latin America, Africa • Spotcap is a new online credit platform that provides fast and flexible financing for small businesses. Spotcap uses an innovative credit scoring technology that directly evaluates real-time business data to provide fast and flexible financing Target Sectors Fintech, data science, consumer lending, mobile and internet • Viventor has been partnering with various non-bank lenders from all over Europe, and offering investments in their loans to every European with as little as 50 Euros in Investment Style Active savings. The peer-to-peer lending platform is now set to build a pan-European loan marketplace that would be comparable to a Stock Market Deal Structures Control, joint control, minority KEY CONTACTS Strong management teams • Nicholas Jordan • An investment banker with more than 20 years of Key Investment Criteria Scalable business model experience in senior and executive positions in Existing innovative product • Finstar Financial Group, CEO leading global financial institutions Global market potential • E-mail: [email protected] • Companies: Goldman Sachs, Deutsche Bank Website www.finstar.com • Mark Ruddock • Joined Finstar in 2016 to help accelerate its financial • FinstarLabs, CEO technology investment program. Contact Email [email protected] • E-mail: [email protected] • Mark’s 15 year career in venture-backed startups has spanned enterprise software, mobile applications and Contact Phone 7 495 7879260 (2947) on-line financial services, and includes 2 exits. • Companies: Wonga, Viigo, INEA

NOAH 2016 London Investor Book Page 78 Page 80

NOAH 2016 London Investor Book Page 78 Page 80