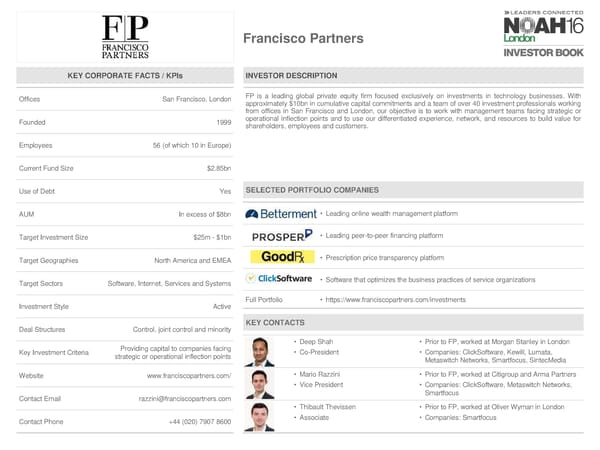

Francisco Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices San Francisco, London FP is a leading global private equity firm focused exclusively on investments in technology businesses. With approximately $10bn in cumulative capital commitments and a team of over 40 investment professionals working from offices in San Francisco and London, our objective is to work with management teams facing strategic or Founded 1999 operational inflection points and to use our differentiated experience, network, and resources to build value for shareholders, employees and customers. Employees 56 (of which 10 in Europe) Current Fund Size $2.85bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM In excess of $8bn • Leading online wealth management platform Target Investment Size $25m - $1bn • Leading peer-to-peer financing platform Target Geographies North America and EMEA • Prescription price transparency platform Target Sectors Software, Internet, Services and Systems • Software that optimizes the business practices of service organizations Investment Style Active Full Portfolio • https://www.franciscopartners.com/investments Deal Structures Control, joint control and minority KEY CONTACTS Providing capital to companies facing • Deep Shah • Prior to FP, worked at Morgan Stanley in London Key Investment Criteria strategic or operational inflection points • Co-President • Companies: ClickSoftware, Kewill, Lumata, Metaswitch Networks, Smartfocus, SintecMedia Website www.franciscopartners.com/ • Mario Razzini • Prior to FP, worked at Citigroup and Arma Partners • Vice President • Companies: ClickSoftware, Metaswitch Networks, Contact Email razzini@franciscopartners.com Smartfocus • Thibault Thevissen • Prior to FP, worked at Oliver Wyman in London Contact Phone +44 (020) 7907 8600 • Associate • Companies: Smartfocus

NOAH 2016 London Investor Book Page 79 Page 81

NOAH 2016 London Investor Book Page 79 Page 81