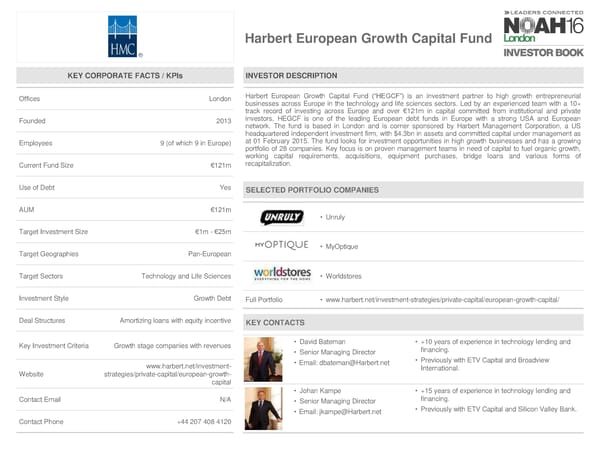

Harbert European Growth Capital Fund KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Harbert European Growth Capital Fund (“HEGCF”) is an investment partner to high growth entrepreneurial businesses across Europe in the technology and life sciences sectors. Led by an experienced team with a 10+ track record of investing across Europe and over €121m in capital committed from institutional and private Founded 2013 investors, HEGCF is one of the leading European debt funds in Europe with a strong USA and European network. The fund is based in London and is corner sponsored by Harbert Management Corporation, a US headquartered independent investment firm, with $4.3bn in assets and committed capital under management as Employees 9 (of which 9 in Europe) at 01 February 2015. The fund looks for investment opportunities in high growth businesses and has a growing portfolio of 28 companies. Key focus is on proven management teams in need of capital to fuel organic growth, working capital requirements, acquisitions, equipment purchases, bridge loans and various forms of Current Fund Size €121m recapitalization. Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM €121m • Unruly Target Investment Size €1m - €25m • MyOptique Target Geographies Pan-European Target Sectors Technology and Life Sciences • Worldstores Investment Style Growth Debt Full Portfolio • www.harbert.net/investment-strategies/private-capital/european-growth-capital/ Deal Structures Amortizing loans with equity incentive KEY CONTACTS Key Investment Criteria Growth stage companies with revenues • David Bateman • +10 years of experience in technology lending and • Senior Managing Director financing. www.harbert.net/investment- • Email: dbateman@Harbert.net • Previously with ETV Capital and Broadview Website strategies/private-capital/european-growth- International. capital • Johan Kampe • +15 years of experience in technology lending and Contact Email N/A • Senior Managing Director financing. • Email: jkampe@Harbert.net • Previously with ETV Capital and Silicon Valley Bank. Contact Phone +44 207 408 4120

NOAH 2016 London Investor Book Page 83 Page 85

NOAH 2016 London Investor Book Page 83 Page 85