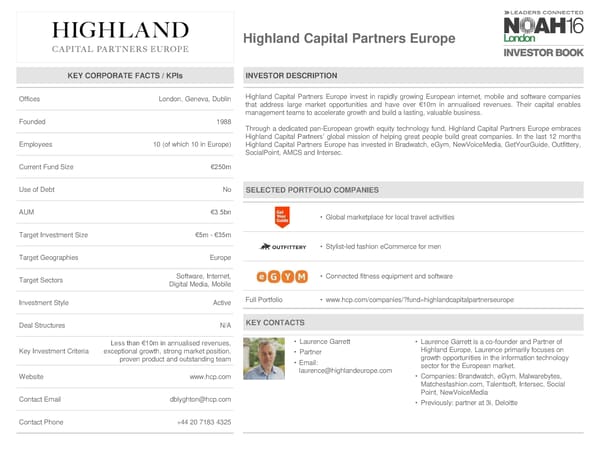

Highland Capital Partners Europe KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Geneva, Dublin Highland Capital Partners Europe invest in rapidly growing European internet, mobile and software companies that address large market opportunities and have over €10m in annualised revenues. Their capital enables managementteamstoaccelerate growth and build a lasting, valuable business. Founded 1988 Through a dedicated pan-European growth equity technology fund, Highland Capital Partners Europe embraces Highland Capital Partners’ global mission of helping great people build great companies. In the last 12 months Employees 10 (of which 10 in Europe) Highland Capital Partners Europe has invested in Bradwatch, eGym, NewVoiceMedia, GetYourGuide, Outfittery, SocialPoint, AMCS and Intersec. Current Fund Size €250m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €3.5bn • Global marketplace for local travel activities Target Investment Size €5m - €35m • Stylist-led fashion eCommerce for men Target Geographies Europe Target Sectors Software, Internet, • Connected fitness equipment and software Digital Media, Mobile Investment Style Active Full Portfolio • www.hcp.com/companies/?fund=highlandcapitalpartnerseurope Deal Structures N/A KEY CONTACTS Less than €10m in annualised revenues, • Laurence Garrett • Laurence Garrett is a co-founder and Partner of Key Investment Criteria exceptional growth, strong market position, • Partner Highland Europe, Laurence primarily focuses on proven product and outstanding team • Email: growth opportunities in the information technology laurence@highlandeurope.com sector for the European market. Website www.hcp.com • Companies: Brandwatch, eGym, Malwarebytes, Matchesfashion.com, Talentsoft, Intersec, Social Point, NewVoiceMedia Contact Email dblyghton@hcp.com • Previously: partner at 3i, Deloitte Contact Phone +44 20 7183 4325

NOAH 2016 London Investor Book Page 84 Page 86

NOAH 2016 London Investor Book Page 84 Page 86