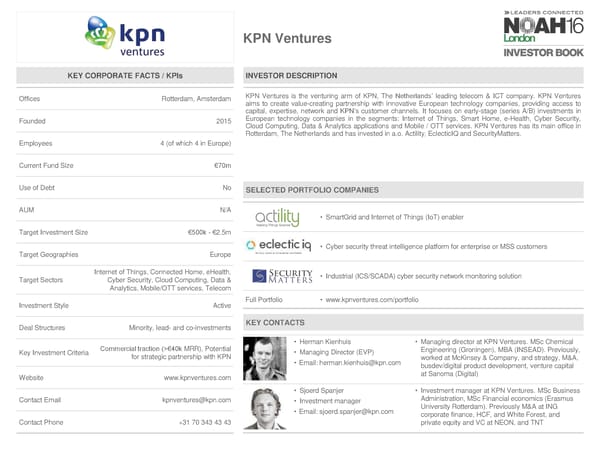

KPN Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Rotterdam, Amsterdam KPN Ventures is the venturing arm of KPN, The Netherlands’ leading telecom & ICT company. KPN Ventures aims to create value-creating partnership with innovative European technology companies, providing access to capital, expertise, network and KPN’s customer channels. It focuses on early-stage (series A/B) investments in Founded 2015 European technology companies in the segments: Internet of Things, Smart Home, e-Health, Cyber Security, Cloud Computing, Data & Analytics applications and Mobile / OTT services. KPN Ventures has its main office in Rotterdam, The Netherlands and has invested in a.o. Actility, EclecticIQ and SecurityMatters. Employees 4 (of which 4 in Europe) Current Fund Size €70m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • SmartGrid and Internet of Things (IoT) enabler Target Investment Size €500k - €2.5m • Cyber security threat intelligence platform for enterprise or MSS customers Target Geographies Europe Internet of Things, Connected Home, eHealth, • Industrial (ICS/SCADA) cyber security network monitoring solution Target Sectors Cyber Security, Cloud Computing, Data & Analytics, Mobile/OTT services, Telecom Investment Style Active Full Portfolio • www.kpnventures.com/portfolio Deal Structures Minority, lead- and co-investments KEY CONTACTS • Herman Kienhuis • Managing director at KPN Ventures. MSc Chemical Key Investment Criteria Commercial traction (>€40k MRR), Potential • Managing Director (EVP) Engineering (Groningen), MBA (INSEAD). Previously, for strategic partnership with KPN • Email: herman.kienhuis@kpn.com worked at McKinsey & Company, and strategy, M&A, busdev/digital product development, venture capital Website www.kpnventures.com at Sanoma (Digital) • Sjoerd Spanjer • Investment manager at KPN Ventures. MSc Business Contact Email kpnventures@kpn.com • Investment manager Administration, MSc Financial economics (Erasmus • Email: sjoerd.spanjer@kpn.com University Rotterdam). Previously M&A at ING corporate finance, HCF, and White Forest, and Contact Phone +31 70 343 43 43 private equity and VC at NEON, and TNT

NOAH 2016 London Investor Book Page 47 Page 49

NOAH 2016 London Investor Book Page 47 Page 49