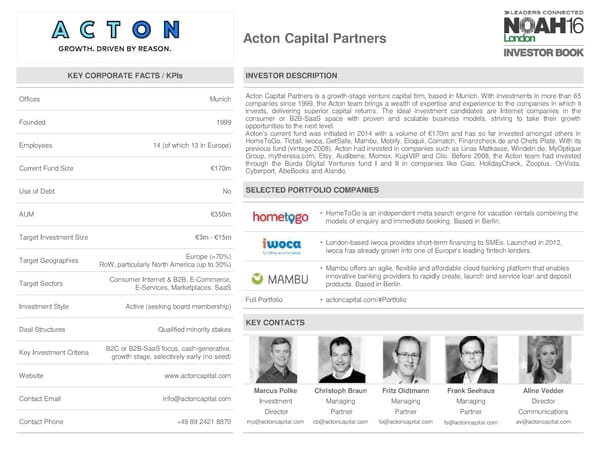

Acton Capital Partners KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Munich Acton Capital Partners is a growth-stage venture capital firm, based in Munich. With investments in more than 65 companies since 1999, the Acton team brings a wealth of expertise and experience to the companies in which it invests, delivering superior capital returns. The ideal investment candidates are Internet companies in the Founded 1999 consumer or B2B-SaaS space with proven and scalable business models, striving to take their growth opportunities to the next level. Acton’s current fund was initiated in 2014 with a volume of €170m and has so far invested amongst others in Employees 14 (of which 13 in Europe) HomeToGo,Tictail, iwoca, GetSafe, Mambu, Mobify, Eloquii, Comatch, Finanzcheck.de and Chefs Plate. With its previous fund (vintage 2008), Acton had invested in companies such as Linas Matkasse, Windeln.de, MyOptique Group, mytheresa.com, Etsy, Audibene, Momox, KupiVIP and Clio. Before 2008, the Acton team had invested Current Fund Size €170m through the Burda Digital Ventures fund I and II in companies like Ciao, HolidayCheck, Zooplus, OnVista, Cyberport, AbeBooks and Alando. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €350m • HomeToGois an independent meta search engine for vacation rentals combining the models of enquiry and immediate booking. Based in Berlin. Target Investment Size €3m - €15m • London-based iwoca provides short-term financing to SMEs. Launched in 2012, Europe (>70%) iwoca has already grown into one of Europe's leading fintech lenders. Target Geographies RoW, particularly North America (up to 30%) • Mambuoffers an agile, flexible and affordable cloud banking platform that enables Consumer Internet & B2B, E-Commerce, innovative banking providers to rapidly create, launch and service loan and deposit Target Sectors E-Services, Marketplaces, SaaS products. Based in Berlin. Investment Style Active (seeking board membership) Full Portfolio • actoncapital.com/#Portfolio Deal Structures Qualified minority stakes KEY CONTACTS Key Investment Criteria B2C or B2B-SaaS focus, cash-generative, growth stage, selectively early (no seed) Website www.actoncapital.com Marcus Polke Christoph Braun Fritz Oidtmann Frank Seehaus Aline Vedder Contact Email info@actoncapital.com Investment Managing Managing Managing Director Director Partner Partner Partner Communications Contact Phone +49 89 2421 8870 mp@actoncapital.com cb@actoncapital.com fo@actoncapital.com fs@actoncapital.com av@actoncapital.com

NOAH 2016 London Investor Book Page 13 Page 15

NOAH 2016 London Investor Book Page 13 Page 15