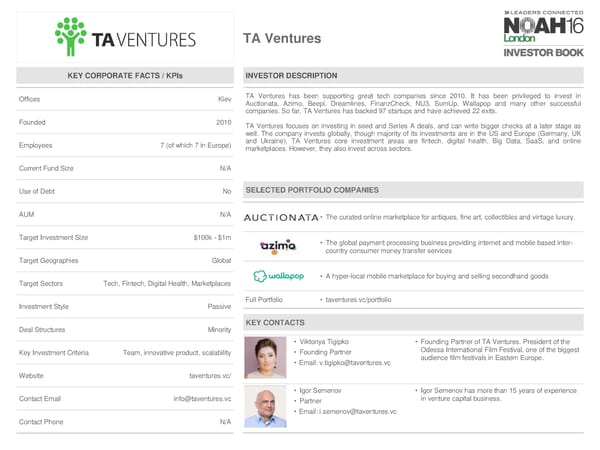

TA Ventures KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Kiev TA Ventures has been supporting great tech companies since 2010. It has been privileged to invest in Auctionata, Azimo, Beepi, Dreamlines, FinanzCheck, NU3, SumUp, Wallapop and many other successful companies. So far, TA Ventures has backed 97 startups and have achieved 22 exits. Founded 2010 TA Ventures focuses on investing in seed and Series A deals, and can write bigger checks at a later stage as well. The company invests globally, though majority of its investments are in the US and Europe (Germany, UK Employees 7 (of which 7 in Europe) and Ukraine). TA Ventures core investment areas are fintech, digital health, Big Data, SaaS, and online marketplaces. However, they also invest across sectors. Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES AUM N/A • The curated online marketplace for antiques, fine art, collectibles and vintage luxury. Target Investment Size $100k - $1m • The global payment processing business providing internet and mobile based inter- country consumer money transfer services Target Geographies Global • A hyper-local mobile marketplace for buying and selling secondhand goods Target Sectors Tech, Fintech, Digital Health, Marketplaces Investment Style Passive Full Portfolio • taventures.vc/portfolio Deal Structures Minority KEY CONTACTS • Viktoriya Tigipko • Founding Partner of TA Ventures. President of the Key Investment Criteria Team,innovative product, scalability • Founding Partner Odessa International Film Festival, one of the biggest • Email: v.tigipko@taventures.vc audience film festivals in Eastern Europe. Website taventures.vc/ • Igor Semenov • Igor Semenov has more than 15 years of experience Contact Email info@taventures.vc • Partner in venture capital business. • Email: i.semenov@taventures.vc Contact Phone N/A

NOAH 2016 London Investor Book Page 64 Page 66

NOAH 2016 London Investor Book Page 64 Page 66