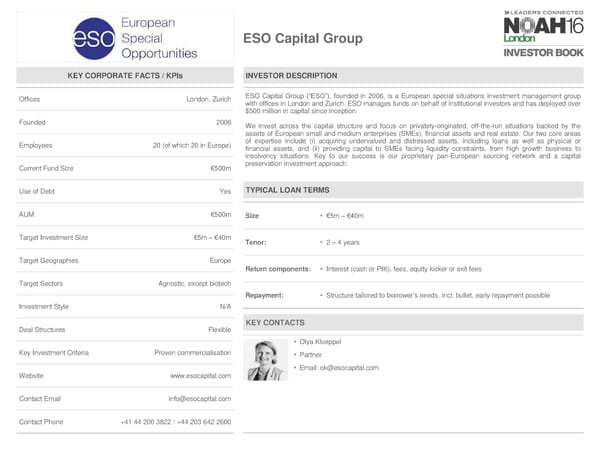

ESO Capital Group KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London, Zurich ESO Capital Group (“ESO”), founded in 2006, is a European special situations investment management group with offices in London and Zurich. ESO manages funds on behalf of institutional investors and has deployed over $500 million in capital since inception. Founded 2006 We invest across the capital structure and focus on privately-originated, off-the-run situations backed by the assets of European small and medium enterprises (SMEs), financial assets and real estate. Our two core areas Employees 20 (of which 20 in Europe) of expertise include (i) acquiring undervalued and distressed assets, including loans as well as physical or financial assets, and (ii) providing capital to SMEs facing liquidity constraints, from high growth business to insolvency situations. Key to our success is our proprietary pan-European sourcing network and a capital Current Fund Size €500m preservation investment approach. Use of Debt Yes TYPICAL LOAN TERMS AUM €500m Size • €5m – €40m Target Investment Size €5m–€40m Tenor: • 2 – 4 years Target Geographies Europe Return components: • Interest (cash or PIK), fees, equity kicker or exit fees Target Sectors Agnostic, except biotech Repayment: • Structure tailored to borrower’s needs, incl. bullet, early repayment possible Investment Style N/A Deal Structures Flexible KEY CONTACTS • Olya Klueppel Key Investment Criteria Proven commercialisation • Partner • Email: ok@esocapital.com Website www.esocapital.com Contact Email info@esocapital.com Contact Phone +41 44 200 3822 / +44 203 642 2600

NOAH 2016 London Investor Book Page 94 Page 96

NOAH 2016 London Investor Book Page 94 Page 96