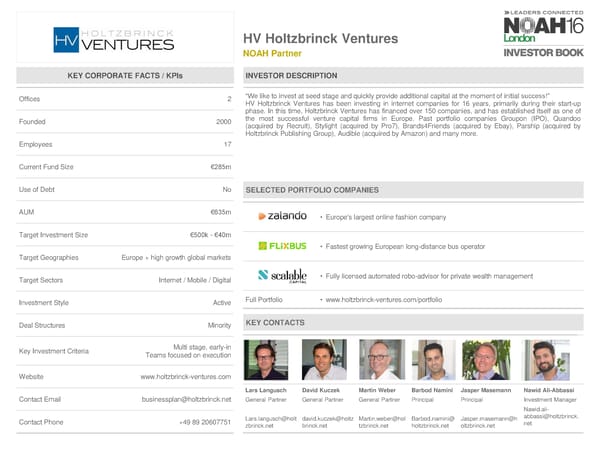

HV Holtzbrinck Ventures NOAH Partner KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices 2 “Weliketo invest at seed stage and quickly provide additional capital at the moment of initial success!” HV Holtzbrinck Ventures has been investing in internet companies for 16 years, primarily during their start-up phase. In this time, Holtzbrinck Ventures has financed over 150 companies, and has established itself as one of Founded 2000 the most successful venture capital firms in Europe. Past portfolio companies Groupon (IPO), Quandoo (acquired by Recruit), Stylight (acquired by Pro7), Brands4Friends (acquired by Ebay), Parship (acquired by Holtzbrinck Publishing Group), Audible (acquired by Amazon) and many more. Employees 17 Current Fund Size €285m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €635m • Europe's largest online fashion company Target Investment Size €500k - €40m • Fastest growing European long-distance bus operator Target Geographies Europe + high growth global markets Target Sectors Internet / Mobile / Digital • Fully licensed automated robo-advisor for private wealth management Investment Style Active Full Portfolio • www.holtzbrinck-ventures.com/portfolio Deal Structures Minority KEY CONTACTS Key Investment Criteria Multi stage, early-in Teams focused on execution Website www.holtzbrinck-ventures.com Lars Langusch David Kuczek Martin Weber Barbod Namini Jasper Masemann Nawid Ali-Abbassi Contact Email businessplan@holtzbrinck.net General Partner General Partner General Partner Principal Principal Investment Manager Nawid.ali- Contact Phone +49 89 20607751 Lars.langusch@holt david.kuczek@holtz Martin.weber@hol Barbod.namini@ Jasper.masemann@h abbassi@holtzbrinck. zbrinck.net brinck.net tzbrinck.net holtzbrinck.net oltzbrinck.net net

NOAH 2016 London Investor Book Page 40 Page 42

NOAH 2016 London Investor Book Page 40 Page 42