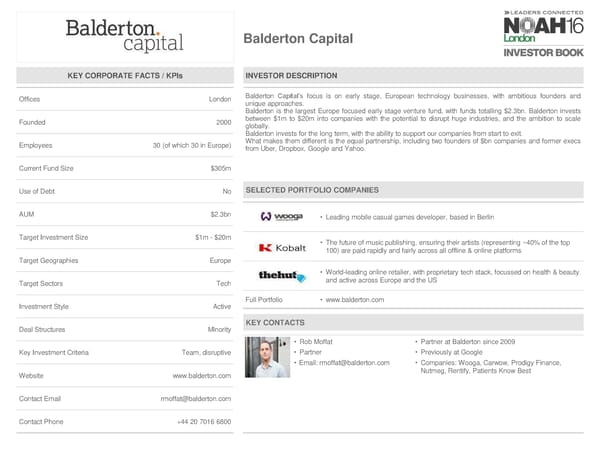

Balderton Capital KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices London Balderton Capital’s focus is on early stage, European technology businesses, with ambitious founders and unique approaches. Balderton is the largest Europe focused early stage venture fund, with funds totalling $2.3bn. Balderton invests Founded 2000 between $1m to $20m into companies with the potential to disrupt huge industries, and the ambition to scale globally. Balderton invests for the long term, with the ability to support our companies from start to exit. Employees 30 (of which 30 in Europe) What makes them different is the equal partnership, including two founders of $bn companies and former execs from Uber, Dropbox, Google and Yahoo. Current Fund Size $305m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $2.3bn • Leading mobile casual games developer, based in Berlin Target Investment Size $1m - $20m • The future of music publishing, ensuring their artists (representing ~40% of the top 100) are paid rapidly and fairly across all offline & online platforms Target Geographies Europe • World-leading online retailer, with proprietary tech stack, focussed on health & beauty Target Sectors Tech and active across Europe and the US Investment Style Active Full Portfolio • www.balderton.com Deal Structures Minority KEY CONTACTS • Rob Moffat • Partner at Balderton since 2009 Key Investment Criteria Team, disruptive • Partner • Previously at Google • Email: rmoffat@balderton.com • Companies: Wooga, Carwow, Prodigy Finance, Website www.balderton.com Nutmeg, Rentify, Patients Know Best Contact Email rmoffat@balderton.com Contact Phone +44207016 6800

NOAH 2016 London Investor Book Page 16 Page 18

NOAH 2016 London Investor Book Page 16 Page 18