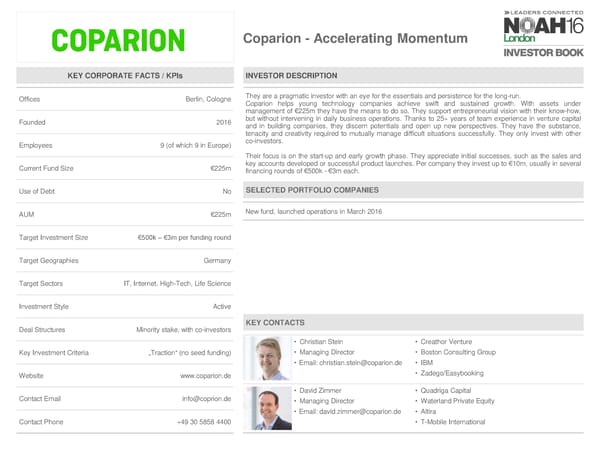

Coparion - Accelerating Momentum KEY CORPORATE FACTS / KPIs INVESTOR DESCRIPTION Offices Berlin, Cologne They are a pragmatic investor with an eye for the essentials and persistence for the long-run. Coparion helps young technology companies achieve swift and sustained growth. With assets under management of €225m they have the means to do so. They support entrepreneurial vision with their know-how, Founded 2016 but without intervening in daily business operations. Thanks to 25+ years of team experience in venture capital and in building companies, they discern potentials and open up new perspectives. They have the substance, tenacity and creativity required to mutually manage difficult situations successfully. They only invest with other Employees 9 (of which 9 in Europe) co-investors. Their focus is on the start-up and early growth phase. They appreciate initial successes, such as the sales and Current Fund Size €225m key accounts developed or successful product launches. Per company they invest up to €10m, usually in several financing rounds of €500k - €3m each. Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €225m New fund, launched operations in March 2016 Target Investment Size €500k – €3m per funding round Target Geographies Germany Target Sectors IT, Internet, High-Tech, Life Science Investment Style Active Deal Structures Minority stake, with co-investors KEY CONTACTS • Christian Stein • Creathor Venture Key Investment Criteria „Traction“ (no seed funding) • Managing Director • Boston Consulting Group • Email: christian.stein@coparion.de • IBM Website www.coparion.de • Zadego/Easybooking • David Zimmer • Quadriga Capital Contact Email info@coprion.de • Managing Director • Waterland Private Equity • Email: david.zimmer@coparion.de • Altira Contact Phone +4930 5858 4400 • T-Mobile International

NOAH 2016 London Investor Book Page 24 Page 26

NOAH 2016 London Investor Book Page 24 Page 26